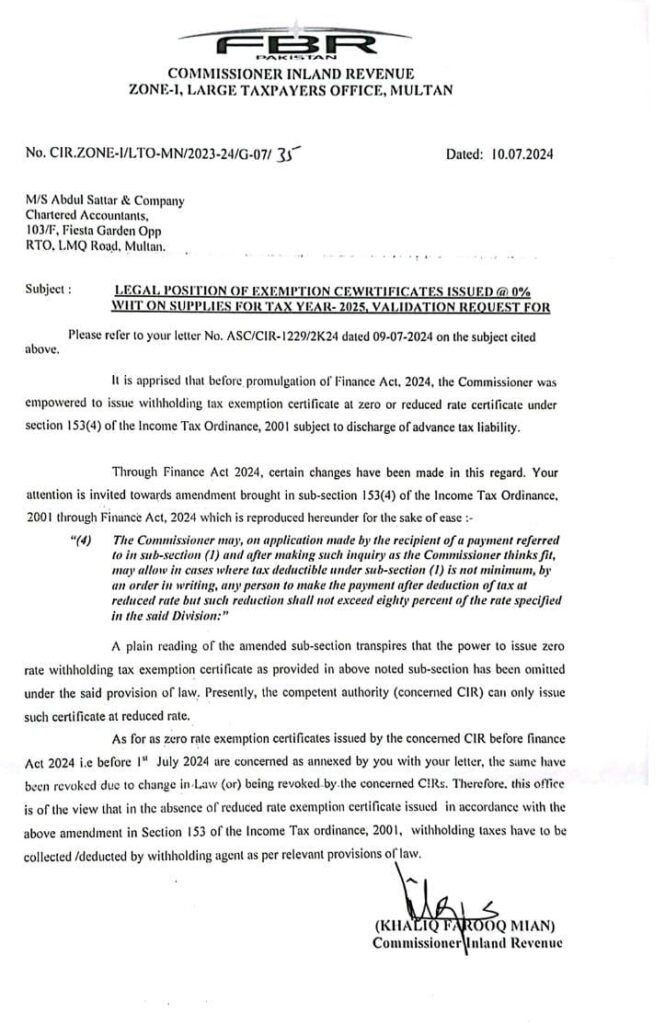

Tax Exemption Certificate on 0% rate Supplies dt 10.07.2024

OFFICE MEMORANDUM

Subject: Tax Exemption Certificate

It is apprised that before promulgation of Finance Act, 2024, the Commissioner was empowered to issue withholding tax exemption certificate at zero or reduced rate certificate under section 153(4) of the Income Tax Ordinance, 2001 subject to discharge of advance tax liability.

Through Finance Act 2024, certain changes have been made in this regard. Your attention is invited towards amendment brought in sub-section 153(4) of the Income Tax Ordinance. 2001 through Finance Act, 2024 which is reproduced hereunder for the sake of ease :-

“(4) The Commissioner may, on application made by the recipient of a payment referred to in sub-section (1) and after making such inquiry as the Commissioner thinks fit, may allow in cases where tax deductible under sub-section (1) is not minimum, by an order in writing, any person to make the payment after deduction of tax at reduced rate but such reduction shall not exceed eighty percent of the rate specified in the said Division:”

A plain reading of the amended sub-section transpires that the power to issue zero rate withholding tax exemption certificate as provided in above noted sub-section has been omitted under the said provision of law. Presently, the competent authority (concerned CIR) can only issue such certificate at reduced rate.

As for as zero rate exemption certificates issued by the concerned CIR before finance Act 2024 i.e before 1″ July 2024 are concerned as annexed by you with your letter, the same have been revoked due to change in Law (or) being revoked by the concerned CIRs. Therefore, this office is of the view that in the absence of reduced rate exemption certificate issued in accordance with the above amendment in Section 153 of the Income Tax ordinance, 2001, withholding taxes have to be collected /deducted by withholding agent as per relevant provisions of law.

A “Tax Exemption Certificate on 0% Rate Supplies” refers to a special document issued by tax authorities that allows certain businesses or individuals to provide goods and services at a 0% tax rate. The certificate is important for businesses engaged in specific types of sales or exports where the government has decided that no tax should be applied.

Here’s a simple breakdown of what it means:

Key Points of the Tax Exemption Certificate:

- Zero-Rated Supplies: Some goods and services are considered “zero-rated,” which means that while they are taxable under the law, the tax rate applied is 0%. Common examples include exports of goods, certain food items, or services related to health and education. Instead of charging a normal tax rate (like 10% or 15%), these supplies are taxed at 0%.

- Who Needs the Certificate? Businesses that deal in zero-rated goods or services need this certificate to prove that they are allowed to apply the 0% tax rate. Without the certificate, they may face complications during audits or might have to charge the standard tax rate.

- Application Process: Businesses or individuals must apply for the Tax Exemption Certificate with their local tax authority. They will need to provide information about their business, the type of goods or services they supply, and proof that they qualify for the 0% tax rate. Once approved, the certificate is issued, allowing them to supply goods or services without charging any tax.

- Benefits of the Certificate:

- Cost Saving for Buyers: Customers who purchase from businesses with this certificate don’t pay taxes on those goods or services, making it cheaper for them.

- Promotes Exporting: Zero-rating is often applied to exports to make a country’s goods more competitive internationally.

- Tax Refunds: In some cases, businesses dealing in zero-rated supplies can claim refunds on any input taxes they paid while producing these goods or services.

Conclusion:

The Tax Exemption Certificate for 0% rate supplies is a helpful tool for businesses and individuals that provide goods or services without applying taxes. It ensures that they can legally offer tax-free products, helps them remain competitive, and supports certain sectors like exports.