Special Family Pension-Federal dt 10.09.2024

OFFICE MEMORANDUM

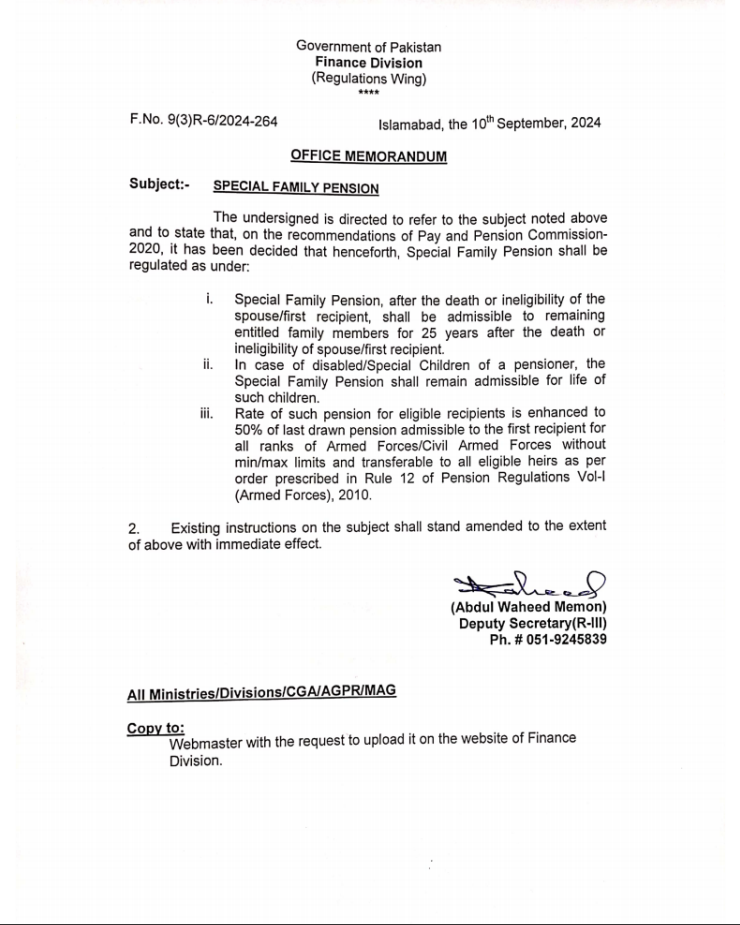

Special Family Pension

The undersigned is directed to refer to Finance Division’s O.M. No. 1(13)-Reg.6/83 dated 23.10.1983 on the subject noted above and to state that, on the recommendations of Pay and Pension Commission-2020, it has been decided that henceforth, Ordinary Family Pension, after the death or ineligibility of the spouse, shall be admissible to remaining entitled family members for a maximum period of 10 years, provided that;

i. In case of disabled/Special Children of a pensioner, the Ordinary Family Pension shall remain admissible for life of such children.

ii. In case of the entitled children, Ordinary Family Pension shall remain admissible for 10 years or till the age of 21 years which so ever is later.

2. Existing instructions on the subject shall stand amended to the extent of above with immediate effect.

The Special Family Pension (SFP) is a welfare benefit provided to the families of government employees or military personnel who die in the line of duty. Its purpose is to offer financial assistance and support to the bereaved family, acknowledging the service and sacrifice of the deceased individual. It plays a crucial role in helping the family cope with the financial implications of losing their primary breadwinner.

Eligibility Criteria

The Special Family Pension is primarily granted to the spouse of the deceased. However, if the spouse is not alive or there is no spouse, the pension can be passed on to other eligible family members, such as dependent children or dependent parents. The primary condition for the SFP is that the death must be linked to service-related duties. This includes deaths during combat, accidents while on duty, or any other incident connected to the individual’s official role.

In some cases, adopted children or siblings may also be considered eligible if they were financially dependent on the deceased. The process to determine eligibility often involves an investigation to confirm the cause of death and its connection to the individual’s service.

Amount and Benefits

The amount provided under the Special Family Pension is usually more than the regular family pension. It is often calculated as a percentage of the last salary that the deceased was drawing at the time of their death. Typically, this amount can go up to 60% of the last drawn salary. However, the percentage may vary depending on the specific policies of the armed forces, government department, or institution the deceased was employed with.

In addition to the regular monthly pension, families may receive additional benefits. These can include educational scholarships for children, medical benefits for the family, and sometimes even housing assistance. In some cases, the family may also receive a lump-sum payment to help with immediate expenses following the death of their loved one.

Importance of the SFP

The Special Family Pension is not just a financial provision; it is also symbolic of the government or institution’s recognition of the sacrifice made by the deceased. Military personnel, in particular, face life-threatening situations as part of their jobs, and the risk of death is an ever-present reality. The SFP serves as a form of reassurance to service members that their families will be taken care of should the worst happen.

For the families, it provides a crucial source of income in a time of emotional and financial distress. Losing a loved one is already a heavy burden, and the pension helps reduce the additional stress of financial insecurity.

Conclusion

The Special Family Pension is a critical benefit for families who lose a member while they are serving the nation or in government service. It not only provides financial relief but also honors the sacrifices made by those who put their lives on the line. By offering sustained financial support, the SFP ensures that the family of the deceased can maintain a basic standard of living and access essential services like education and healthcare.