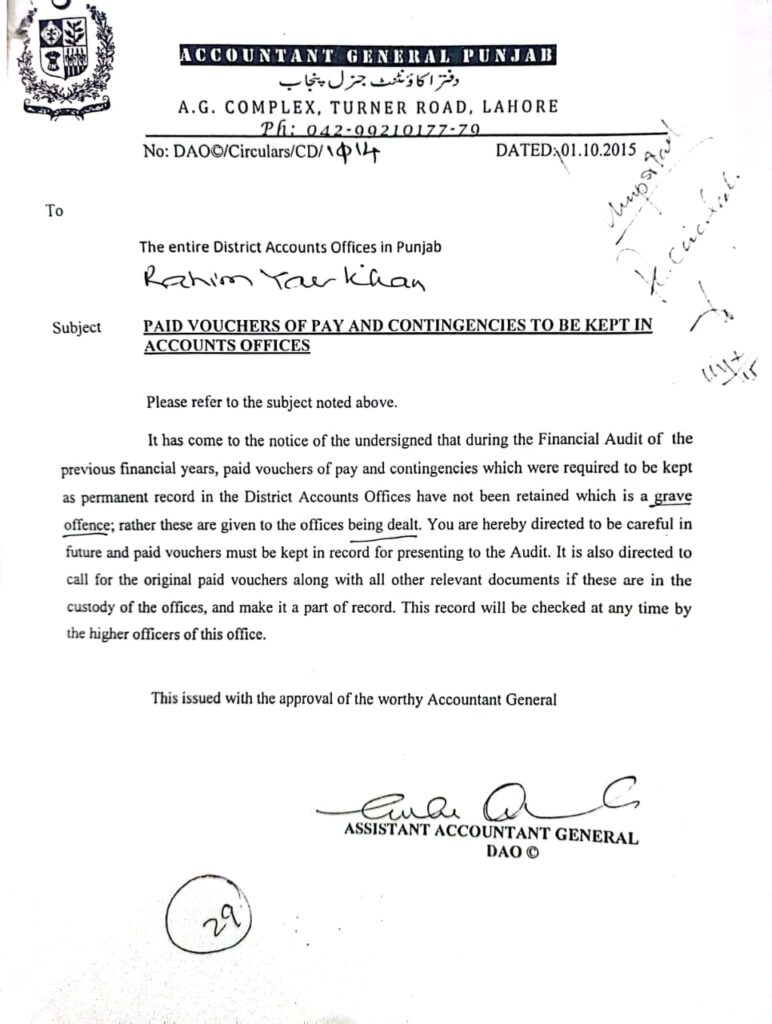

Safe Custody of Record in Accounts Offices –AG dt 01.10.2015

It has come to the notice of the undersigned that during the financial audit of previous financial years, paid vouchers of pay and contingencies, which are required to be kept as permanent records in the District Accounts Offices, have not been retained. This is a grave offence, as these vouchers were given to the offices being dealt. You are hereby directed to ensure that in the future, paid vouchers must be retained in the record for presentation to the audit. Furthermore, you are instructed to call for the original paid vouchers along with all other relevant documents if they are currently in the custody of other offices, and make them part of the permanent record. This record will be subject to inspection by higher officers of this office at any time.

(This issue is with the approval of the worthy Accountant General).

Assistant Accountant General DAO

Copy to:

- SPS to Accountant General Punjab.

SEO Optimized Content: Ensuring Safe Custody of Records in Accounts Offices

The Office of the Accountant General Punjab, located at A.G. Complex, Turner Road, Lahore, issued a significant directive on October 1, 2015, emphasizing the need for secure custody of records in all District Accounts Offices across Punjab. This directive, identified as DAOO/Circulars/CD/144, highlights the crucial role of proper record-keeping in maintaining the integrity and accountability of financial data.

Importance of Secure Record-Keeping in Accounts Offices

Secure record-keeping is fundamental to effective financial management in any organization, particularly in governmental accounts offices. Ensuring the safe custody of records helps protect sensitive financial information, ensures compliance with legal and regulatory requirements, and upholds public trust. By implementing robust security measures for record storage, accounts offices can mitigate risks such as data breaches, unauthorized access, and loss of critical documents.

Key Directives for Safe Custody of Records

The directive from the Office of the Accountant General Punjab mandates all District Accounts Offices to adopt stringent measures for the safe custody of records. Here are the key points emphasized in the directive:

- Secure Storage Facilities: All accounts offices must ensure that paid vouchers of pay and contingencies are stored in secure, locked facilities. These storage areas should be accessible only to authorized personnel to prevent unauthorized access and potential tampering with documents.

- Retention of Paid Vouchers: It is imperative that paid vouchers of pay and contingencies be retained as permanent records within the District Accounts Offices. This retention is crucial for future audits and ensures that all financial transactions are properly documented and available for review.

- Regular Audits and Inspections: Conducting regular audits and inspections of record storage facilities is essential to identify and address any security vulnerabilities. These audits should be documented and reviewed periodically to ensure compliance with established security protocols.

- Retrieval of Original Documents: If original paid vouchers and other relevant documents are currently in the custody of other offices, the District Accounts Offices are instructed to call for these documents and integrate them into the permanent record. This ensures that all necessary documentation is centralized and readily available for audit purposes.

Implications of Non-Compliance

Non-compliance with these directives can result in significant consequences, including:

- Audit Discrepancies: Failure to retain paid vouchers and other critical documents can lead to discrepancies during financial audits, potentially resulting in financial penalties or other sanctions.

- Legal and Regulatory Breaches: Non-compliance with record-keeping regulations can lead to legal and regulatory breaches, undermining the credibility and reliability of the accounts offices.

- Operational Inefficiencies: Inadequate record-keeping can lead to operational inefficiencies, as the retrieval and verification of financial data become cumbersome and time-consuming.

Conclusion

The directive from the Office of the Accountant General Punjab regarding the safe custody of records in accounts offices is a vital step toward ensuring financial integrity and accountability. By mandating the secure storage and retention of paid vouchers and other critical documents, the directive aims to enhance the reliability and transparency of financial operations within all District Accounts Offices in Punjab.

It is imperative that all accounts offices adhere to these directives and implement robust security measures for record-keeping. Regular audits, secure storage facilities, and the retrieval of original documents are essential practices that will help maintain the integrity of financial data and ensure compliance with audit requirements.