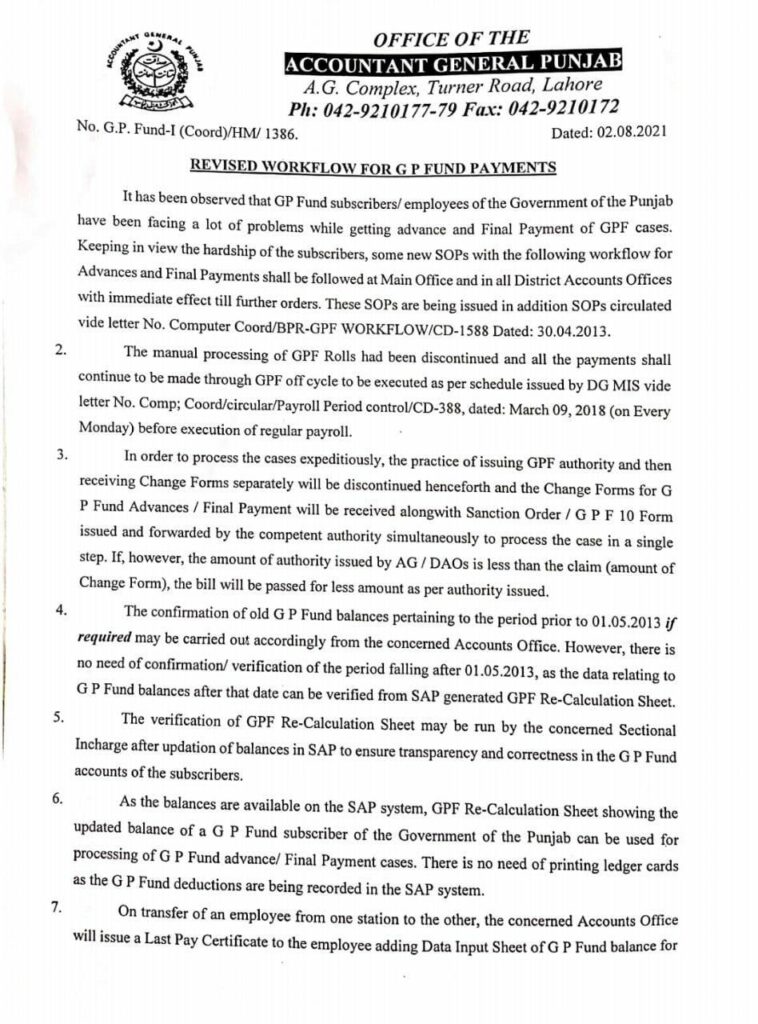

Revised Workflow for GP Fund Payments – AG 02.08.2021

In recent times, employees of the Government of Punjab have encountered various challenges related to the processing of advances and final payments for their General Provident Fund (GPF) cases. To address these issues and streamline the process, the Accountant General Punjab issued new Standard Operating Procedures (SOPs) on August 2, 2021. These updated workflows aim to enhance efficiency and transparency in the management of GPF transactions. This article delves into the details of the revised workflow and the new procedures that have been put in place to facilitate GP Fund payments.

Background of the Revised Workflow

Historically, the GP Fund process involved manual procedures that often led to delays and complications for employees seeking advances or final settlements from their GPF accounts. The need for a more streamlined and efficient system became apparent, prompting the Accountant General Punjab to review and revise the existing workflows. The new SOPs, as outlined in the circular dated 02.08.2021, are designed to overcome these challenges and improve the overall efficiency of the GP Fund payment processes.

Key Updates in the Revised Workflow

1. Transition from Manual to Automated GPF Rolls

One of the major changes in the revised workflow is the discontinuation of manual processing of GPF Rolls. All GPF payments will now be managed through the GP Fund off-cycle payments, as specified in the DG MIS letter No. Comp; Coord/circular/Payroll Period control/CD-388, dated March 1, 2018. This automated approach ensures that GPF transactions are handled more efficiently, with payments being executed every Monday before the regular payroll is processed. This shift to an automated system is expected to reduce processing times and mitigate errors associated with manual procedures.

2. Simplified Processing of GPF Advances and Final Payments

Under the new SOPs, the process for handling GPF advances and final payments has been significantly streamlined. Previously, GPF authorities and Change Forms were processed separately. However, the updated procedure mandates that Change Forms for GPF advances or final payments must be received along with the Sanction Order or GPF-10 Form issued by the competent authority. This combined submission enables the processing of claims in a single step, thereby accelerating the overall process.

3. Handling GPF Authority Amounts

In cases where the authority amount issued by the AG or DAOs is less than the total claim amount indicated in the Change Form, the bill will be passed for the lesser amount as per the authority issued. This adjustment ensures that the processing remains aligned with the sanctioned amounts, and any discrepancies between the authority and the claim are managed according to established guidelines.

4. Verification of GPF Balances

For verification of GPF balances, the new SOPs emphasize the use of SAP-generated GPF Re-Calculation Sheets. There is no longer a requirement to confirm or verify the period after May 1, 2013, as the data from this date forward can be accurately accessed from the SAP system. This change simplifies the verification process, focusing efforts on ensuring data accuracy from earlier periods where necessary.

5. Ensuring Transparency and Correctness in GPF Accounts

The revised workflow outlines a process for the verification of the GPF Re-Calculation Sheet by the concerned Sectional Incharge. This step is crucial for maintaining transparency and ensuring the correctness of GPF account balances. By updating balances in SAP and running the Re-Calculation Sheet, officials can verify the accuracy of GPF accounts without the need for printing ledger cards.

6. Issuance of Last Pay Certificates for Transferred Employees

For employees transferring from one station to another, the concerned Accounts Office is required to issue a Last Pay Certificate along with a Data Input Sheet of the GPF balance. This practice ensures that the GPF balances are accurately transferred and that the receiving office has the necessary information to continue managing the employee’s GPF account.

Detailed SOPs for GP Fund Payments

The detailed SOPs provided in the circular serve as a comprehensive guide for the revised GPF payment processes. These procedures outline the roles and responsibilities of various officials involved in the GPF payment process, ensuring that each step is performed with accuracy and efficiency.

Procedures for Advances and Final Payments

- Submission of Change Forms: Change Forms for GPF advances or final payments must be submitted along with the Sanction Order or GPF-10 Form. This ensures that all necessary documentation is available for a single-step processing of the claim.

- Handling of Authority Amounts: If the GPF authority amount is less than the claimed amount, the bill will be processed for the authority amount issued. This practice ensures alignment with the sanctioned amounts.

- Verification of GPF Balances: The SAP system will be used for verifying GPF balances, and no manual ledger cards are required for periods after May 1, 2013. This change simplifies the balance verification process.

- Issuance of Last Pay Certificates: For employees transferring between stations, a Last Pay Certificate and Data Input Sheet must be issued to ensure accurate GPF balance transfer.

Benefits of the Revised Workflow

The revised workflow for GP Fund payments brings several benefits:

- Increased Efficiency: Automation of GPF Roll processes and the simplification of advance and final payment procedures reduce processing times and minimize errors.

- Enhanced Transparency: The use of SAP-generated Re-Calculation Sheets and the requirement for detailed verification procedures ensure greater transparency in GPF transactions.

- Improved Accuracy: The new procedures for handling GPF authority amounts and balance verifications ensure that GPF transactions are processed accurately.

- Streamlined Processes: Combining the submission of Change Forms and Sanction Orders into a single step streamlines the processing of GPF claims.

Conclusion

The revised workflow for GP Fund payments, as outlined in the Accountant General Punjab’s circular dated August 2, 2021, represents a significant step forward in improving the efficiency, transparency, and accuracy of GPF transactions. By automating processes, simplifying procedures, and enhancing verification methods, these changes are designed to address the challenges faced by GPF subscribers and ensure that their claims are processed in a timely and effective manner.

The implementation of these new SOPs reflects a commitment to optimizing the management of government employees’ GPF accounts and providing better services to the subscribers. All officials and employees involved in the GPF payment process are encouraged to adhere to these revised procedures and contribute to the successful implementation of the new workflow.