Reconciliation of Expenditure –AG 15.03.2012

Reconciliation of expenditure is a cornerstone of effective financial management within government departments and organizations. The Office Order AG 15.03.2012 from the Accountant General highlights the critical importance of regular and accurate reconciliation processes for disbursements. This directive emphasizes that maintaining up-to-date and accurate financial records is not only a regulatory requirement but also essential for obtaining an unqualified audit certificate. In this article, we will explore the procedures, responsibilities, and best practices for effective expenditure reconciliation as outlined in the AG 15.03.2012 directive.

Understanding the Importance of Expenditure Reconciliation

Expenditure reconciliation ensures that all disbursements made by government departments align with the records maintained by the Accounts Offices. This process verifies that all transactions are accurate and properly accounted for, thereby supporting financial integrity and transparency. Regular reconciliation of expenditures is necessary for producing reliable financial reports and achieving accountability in public spending.

Key Objectives of Expenditure Reconciliation

- Accuracy Verification: Ensures that recorded expenditures match actual disbursements.

- Compliance Assurance: Verifies adherence to financial regulations and policies.

- Audit Readiness: Prepares comprehensive and accurate financial statements for external audits.

- Financial Accountability: Supports the correct allocation of funds and prevents unauthorized expenditures.

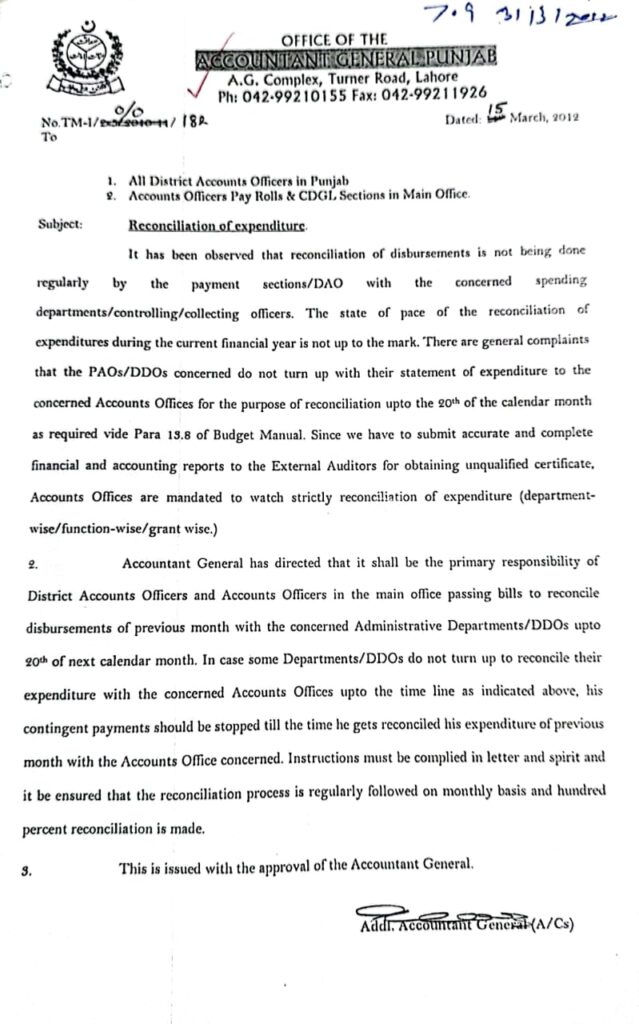

Directive Overview: AG 15.03.2012

On March 15, 2012, the Accountant General issued an office order mandating that all District Accounts Officers (DAOs) and Accounts Officers in the main office follow specific procedures for the reconciliation of expenditures. This directive addresses concerns about irregular reconciliation practices and aims to enhance the reliability of financial reporting.

Summary of the AG 15.03.2012 Directive

- Timely Reconciliation:

- Directive: Reconciliation of expenditures must be performed regularly, with disbursements from the previous month reconciled by the 20th of the current month.

- Importance: Ensures that discrepancies are identified and resolved promptly, preventing the accumulation of unresolved issues.

- Responsibilities of District Accounts Officers and Accounts Officers:

- Directive: DAOs and Accounts Officers are responsible for reconciling disbursements with administrative departments and DDOs (Drawing and Disbursing Officers).

- Importance: Assigns clear accountability for ensuring that reconciliation tasks are completed effectively.

- Contingent Payments:

- Directive: Contingent payments should be halted if the concerned departments or DDOs do not comply with reconciliation deadlines.

- Importance: Enforces adherence to reconciliation schedules and encourages timely completion of reconciliation tasks.

Best Practices for Effective Expenditure Reconciliation

1. Establish Clear Reconciliation Procedures

To achieve effective reconciliation, it is crucial to establish well-defined procedures for the process. This includes:

- Detailed Guidelines: Develop comprehensive guidelines for the reconciliation process, including timelines, required documentation, and procedures for handling discrepancies.

- Standard Operating Procedures (SOPs): Implement SOPs for reconciling expenditures, which should be communicated to all relevant personnel.

2. Ensure Timely Submission of Reconciliation Statements

Timely submission of reconciliation statements is essential for maintaining the accuracy of financial records.

- Submission Deadlines: Ensure that reconciliation statements are submitted to the Accounts Office by the 20th of each month.

- Reminder Systems: Set up reminders for departments and DDOs to submit their statements on time.

3. Maintain Accurate and Complete Records

Accurate record-keeping is fundamental to successful reconciliation efforts.

- Record Maintenance: Keep detailed records of all transactions, including invoices, receipts, and payment vouchers.

- Document Storage: Ensure that all documents are stored securely and are easily accessible for future reference.

4. Conduct Regular Training for Financial Staff

Ongoing training helps staff stay updated on best practices and changes in financial regulations.

- Training Programs: Develop and conduct regular training programs for financial staff on reconciliation procedures, financial regulations, and new technologies.

- Knowledge Updates: Provide updates on any changes to financial policies or procedures.

5. Use Technology for Efficient Reconciliation

Technology can streamline the reconciliation process and improve accuracy.

- Reconciliation Software: Utilize reconciliation software that integrates with financial systems to automate and streamline reconciliation tasks.

- Digital Tools: Use digital tools for tracking, reporting, and managing reconciliation activities.

6. Implement a Robust Review and Approval Process

A strong review process helps ensure that reconciliations are accurate and complete.

- Review Mechanisms: Establish review mechanisms to verify the accuracy of reconciliation statements and resolve any discrepancies.

- Approval Procedures: Implement approval procedures for reconciliation statements to ensure they meet all regulatory requirements.

Addressing Challenges in Expenditure Reconciliation

Despite best efforts, challenges may arise during the reconciliation process. Addressing these challenges proactively can help maintain the effectiveness of reconciliation efforts.

Common Challenges

- Delays in Submission: Departments and DDOs may delay submitting reconciliation statements.

- Discrepancies in Records: Differences between recorded expenditures and actual disbursements.

- Lack of Documentation: Missing or incomplete documentation for transactions.

Strategies for Overcoming Challenges

- Enforce Deadlines: Reinforce the importance of meeting submission deadlines and take corrective actions when necessary.

- Investigate Discrepancies: Perform detailed investigations to identify and resolve discrepancies.

- Improve Documentation Practices: Ensure that all financial transactions are properly documented and retained.

Conclusion

Effective reconciliation of expenditures is a fundamental aspect of financial management in government departments and organizations. The AG 15.03.2012 directive underscores the importance of regular, accurate reconciliation processes to ensure financial accuracy, compliance, and accountability. By following best practices such as establishing clear procedures, ensuring timely submissions, maintaining accurate records, and utilizing technology, financial managers can overcome challenges and achieve effective expenditure reconciliation.

Implementing these strategies will not only help meet regulatory requirements but also support the preparation of accurate financial reports and facilitate a successful audit process. Adhering to the guidelines set forth in AG 15.03.2012 will ultimately strengthen the financial management practices of government departments and ensure that public funds are managed with the utmost integrity and transparency.