Pension contribution for the Period served in Autonomous Body 08.11.2023

OFFICE MEMORANDUM

Subject: Pension contribution

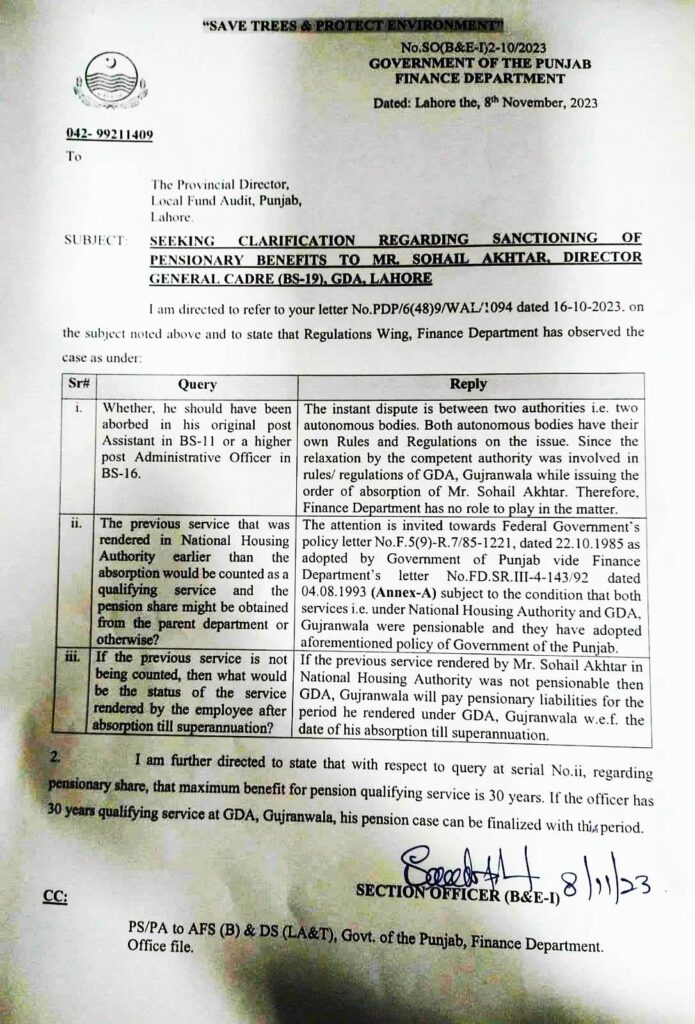

I am directed to refer to your letter No. PDP/6(48)9/WAL/1094 dated 16-10-2023. on the subject noted above and to state that Regulations Wing, Finance Department has observed the case as under:

| Sr# | Query | Reply |

| 1. | Whether he should have been absorbed in his original post Assistant in BS-11 or a higher post Administrative Officer in BS-16. | The instant dispute is between two authorities i.e. two autonomous bodies. Both autonomous bodies have their own Rules and Regulations on the issue. Since the relaxation by the competent authority was involved in rules/regulations of GDA, Gujranwala while issuing the order of absorption of Mr. Sohail Akhtar. Therefore, the Finance Department has no role to play in the matter. |

| 2. | The previous service that was rendered in the National Housing Authority earlier than the absorption would be counted as a qualifying service and the pension share might be obtained from the parent department or otherwise? | The attention is invited towards Federal Government’s policy letter No.F.5(9)-R.7/85-1221, dated 22.10.1985 as adopted by Government of Punjab vide Finance Department’s letter No.FD.SR.III-4-143/92 dated 04.08.1993 (Annex-A) subject to the condition that both services i.e. under National Housing Authority and GDA, Gujranwala were pensionable and they have adopted aforementioned policy of Government of the Punjab. |

| 3. | If the previous service is not being counted, then what would be the status of the service rendered by the employee after absorption till superannuation? | If the previous service rendered by Mr. Sohail Akhtar in National Housing Authority was not pensionable then GDA, Gujranwala will pay pensionary liabilities for the period he rendered under GDA, Gujranwala w.e.f. the date of his absorption till superannuation. |

2. I am further directed to state that with respect to the query at serial No.ii, regarding pensionary pay, that maximum benefit for pension qualifying service is 30 years. If the officer has 30 years qualifying service at GDA, Gujranwala, his pension case can be finalized within this period.