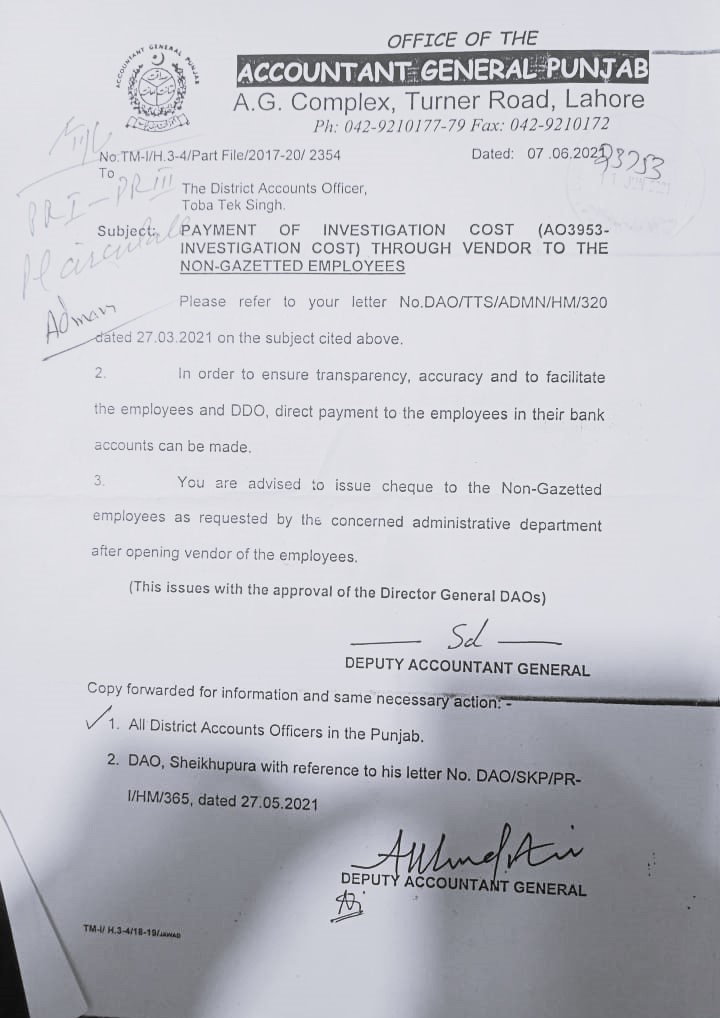

Payment of Investigation Cost A03953 through Vendor –AG 07.06.2021

On June 7, 2021, the Accountant General (AG) issued a directive regarding the payment of investigation costs using Vendor Code A03953. This policy outlines the procedures for handling these payments, ensuring that they are processed efficiently and in compliance with financial regulations. In this article, we will explore the details of this directive, offering insights into the payment process, documentation requirements, and best practices for managing investigation cost payments through vendors.

Understanding the AG Directive on Investigation Cost Payments

The AG’s directive dated June 7, 2021, focuses on the standardized procedures for processing payments related to investigation costs through the vendor code A03953. This directive aims to streamline the payment process, ensure transparency, and uphold the integrity of financial transactions. Here’s a detailed look at the directive’s key components and how they should be implemented.

1. Purpose of the Directive

The primary objective of the directive is to establish a clear, systematic approach for handling payments associated with investigations. The directive mandates that these payments be made through a designated vendor to maintain proper records and ensure that all transactions are compliant with the relevant financial regulations.

Key Objectives:

- Streamline Payment Processes: Simplify the procedures for paying investigation costs.

- Ensure Compliance: Adhere to financial regulations and guidelines.

- Maintain Transparency: Promote transparency in financial transactions related to investigations.

2. Overview of Vendor Code A03953

Vendor Code A03953 is specifically designated for processing payments related to investigation costs. Understanding how to use this code correctly is crucial for ensuring that payments are processed accurately and efficiently.

Vendor Code A03953:

- Purpose: Used exclusively for investigation cost payments.

- Functionality: Facilitates the creation of payment requests and processing of invoices.

Best Practices for Using Vendor Code A03953:

- Correct Code Usage: Ensure that Vendor Code A03953 is used exclusively for investigation cost payments.

- Accurate Documentation: Provide complete and accurate documentation when creating payment requests.

Payment Processing Steps for Investigation Costs

The following steps outline the procedure for processing investigation cost payments using Vendor Code A03953. Adhering to these steps ensures that all transactions are managed efficiently and in compliance with the AG’s directive.

Step 1: Create a Payment Request

The first step in processing a payment for investigation costs is to create a payment request. This involves generating a request for funds to be disbursed to the vendor.

Key Actions:

- Initiate Payment Request: Begin the payment process by initiating a request through the financial management system.

- Enter Vendor Code: Use Vendor Code A03953 to designate the payment for investigation costs.

- Complete Payment Details: Fill out all required fields, including the amount, purpose, and invoice details.

Documentation Required:

- Invoice from the Vendor: A detailed invoice outlining the costs associated with the investigation.

- Approval Documents: Any required approvals or authorizations for the payment.

Step 2: Review and Approve Payment Requests

Once the payment request is created, it must be reviewed and approved by the appropriate authorities.

Key Actions:

- Review Payment Request: Check the payment request for accuracy and completeness.

- Approve Request: Obtain necessary approvals from authorized personnel.

Best Practices:

- Thorough Review: Ensure that all details are correct and that the payment request aligns with the investigation cost documentation.

- Document Approvals: Maintain records of all approvals and authorizations for audit purposes.

Step 3: Process the Payment

After approval, the payment request is processed, and the funds are disbursed to the vendor.

Key Actions:

- Process Payment: Execute the payment through the financial management system.

- Generate Payment Records: Create records of the payment transaction for future reference and auditing.

Best Practices:

- Timely Processing: Ensure that payments are made promptly to avoid delays.

- Maintain Records: Keep detailed records of the payment transaction, including confirmation receipts and transaction details.

Step 4: Reconcile Payments

The final step is to reconcile the payment records to ensure that all transactions are accurately reflected in the financial statements.

Key Actions:

- Reconcile Transactions: Compare payment records against the vendor’s invoice and other documentation.

- Address Discrepancies: Resolve any discrepancies between the payment records and the documentation.

Best Practices:

- Regular Reconciliation: Perform reconciliations on a regular basis to ensure accuracy.

- Document Discrepancies: Keep records of any discrepancies and the actions taken to resolve them.

Compliance Requirements

Following the AG’s directive involves adhering to several compliance requirements to ensure that all payments for investigation costs are handled correctly.

1. Financial Regulations Compliance

Payments must be processed in accordance with established financial regulations and guidelines. This includes adhering to legal requirements and ensuring that all transactions are documented and approved.

Regulations to Follow:

- Public Financial Management Act: Ensure that all payments comply with the regulations outlined in the Public Financial Management Act.

- Audit Requirements: Maintain records and documentation for auditing purposes.

2. Documentation Standards

All documentation related to the payment of investigation costs must meet specific standards for completeness and accuracy.

Documentation Standards:

- Invoice Accuracy: Ensure that invoices are accurate and detailed.

- Approval Records: Keep records of all approvals and authorizations.

3. Transparency and Accountability

Ensuring transparency and accountability in financial transactions is essential for maintaining public trust and ensuring that all processes are above board.

Best Practices for Transparency:

- Clear Documentation: Provide clear and detailed documentation for all payments.

- Regular Audits: Conduct regular audits to ensure that all transactions are compliant with financial regulations.

Best Practices for Managing Investigation Cost Payments

To manage investigation cost payments effectively, consider the following best practices:

1. Accurate and Complete Documentation

Ensure that all documentation related to investigation cost payments is accurate and complete. This includes invoices, approval documents, and payment records.

Best Practices:

- Verify Documents: Double-check all documents for accuracy before submission.

- Organize Records: Maintain well-organized records for future reference and audits.

2. Timely Payment Processing

Process payments promptly to avoid delays and ensure that vendors are paid on time.

Best Practices:

- Schedule Payments: Develop a payment schedule to ensure timely processing.

- Monitor Deadlines: Keep track of payment deadlines and ensure that all requests are processed in a timely manner.

3. Regular Reconciliation

Regularly reconcile payment records to ensure that all transactions are accurate and up-to-date.

Best Practices:

- Perform Regular Checks: Conduct regular reconciliations of payment records.

- Resolve Issues Promptly: Address any discrepancies or issues as soon as they are identified.

Conclusion

The AG’s directive dated June 7, 2021, outlines important procedures for processing payments related to investigation costs using Vendor Code A03953. By following the steps outlined in this article, you can ensure that all payments are processed efficiently, accurately, and in compliance with financial regulations.