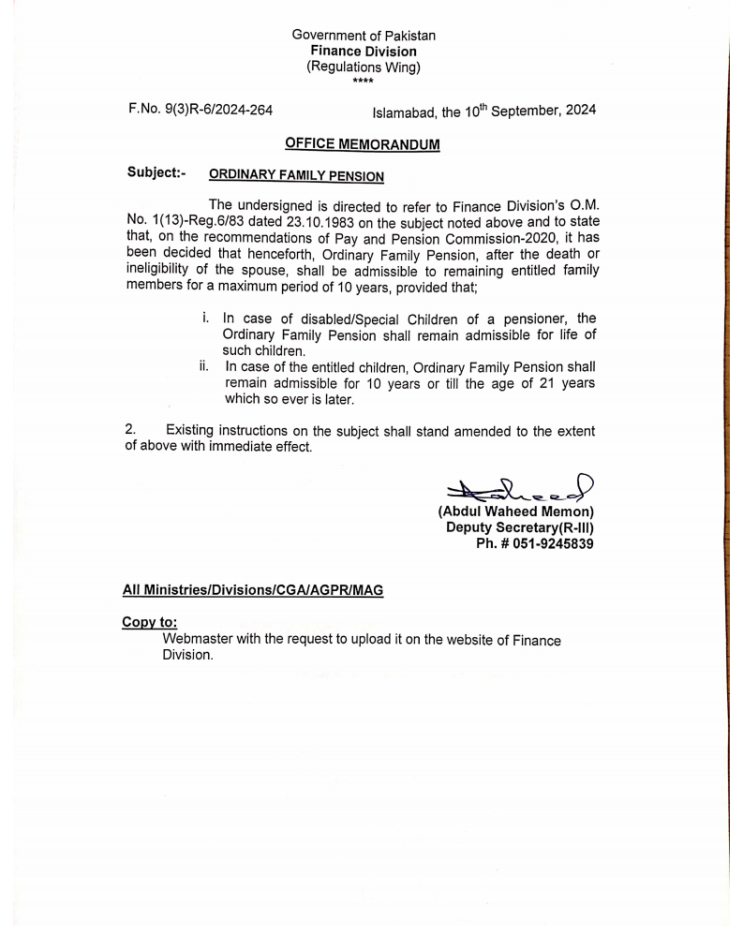

Ordinary Family Pension-Federal-10.09.2024

OFFICE MEMORANDUM

Subject: Ordinary Family Pension

The undersigned is directed to refer to Finance Division’s O.M. No. 1(13)-Reg.6/83 dated 23.10.1983 on the subject noted above and to state that, on the recommendations of Pay and Pension Commission-2020, it has been decided that henceforth, Ordinary Family Pension, after the death or ineligibility of the spouse, shall be admissible to remaining entitled family members for a maximum period of 10 years, provided that;

i. In case of disabled/Special Children of a pensioner, the Ordinary Family Pension shall remain admissible for life of such children.

ii. In case of the entitled children, Ordinary Family Pension shall remain admissible for 10 years or till the age of 21 years which so ever is later.

2. Existing instructions on the subject shall stand amended to the extent of above with immediate effect.

Ordinary Family Pension (10-09-2024)

The Ordinary Family Pension (OFP) is a government scheme designed to provide financial support to the family members of a deceased government employee or pensioner. This pension aims to ensure that the family is not left without financial resources in the unfortunate event of the death of the breadwinner. The pension is typically available to the spouse or eligible family members.

Eligibility for Ordinary Family Pension

- Spouse: In most cases, the surviving spouse is the first eligible recipient of the family pension. If the spouse remarries, the pension may cease, but exceptions exist in cases where the spouse remarries someone related to the deceased, such as the deceased’s brother.

- Children: If there is no surviving spouse, the pension can be passed on to the children. The pension is paid until the child reaches the age of 25, gets married, or secures a job. For unmarried daughters and disabled children, special provisions may allow the pension to continue even after they turn 25.

- Parents and other dependents: If the deceased employee has no spouse or children, the pension may be extended to dependent parents or siblings, though this is usually subject to certain income criteria.

Calculation of the Pension

The amount paid as family pension is usually a percentage of the last drawn salary or pension of the deceased employee. For most central government employees in India, the Ordinary Family Pension is set at 30% of the deceased employee’s last pay or pension. There are two rates of family pension:

- Normal Rate: The family pension is given at a normal rate of 30% of the last pay or pension.

- Enhanced Rate: This rate applies for a period of seven years or until the deceased employee would have reached the age of 67, whichever comes earlier. The enhanced pension is 50% of the last drawn salary or pension.

Duration of Payment

The pension is payable for the lifetime of the spouse or until remarriage. In the case of children, as mentioned, it continues until they turn 25 years old or until they get married, whichever is earlier. Special provisions exist for children with disabilities, allowing them to receive the pension for a longer period.

Taxation and Benefits

The Ordinary Family Pension is usually exempt from taxation under most tax systems up to a certain amount. Additionally, it comes with dearness relief, which is an allowance meant to offset inflation, ensuring that the family pension keeps pace with the rising cost of living.

Conclusion

The Ordinary Family Pension is an essential safety net for families of deceased government employees. It ensures that they can maintain a certain standard of living despite the loss of the main income earner. The pension’s structure, which provides benefits based on the family members’ eligibility and needs, ensures that the support continues for as long as necessary. This scheme reflects the government’s commitment to caring for the welfare of its employees’ families, providing much-needed financial relief during difficult times.