Potential Risk in Operations of Payroll Section -AG dt 29.03.2021

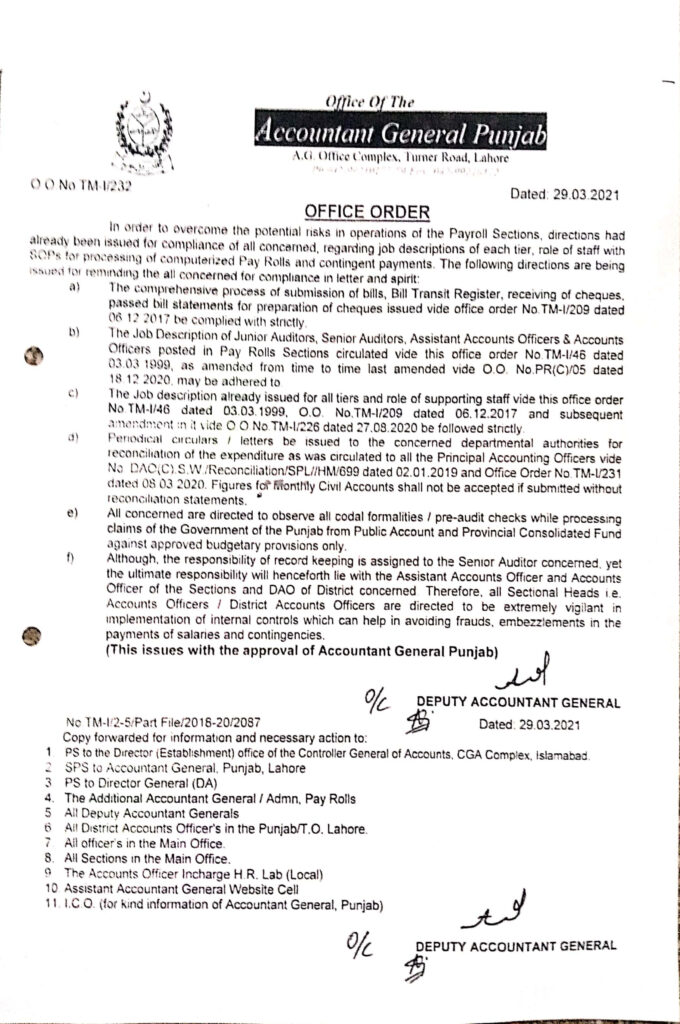

The Office of the Accountant General Punjab, situated at A.G. Office Complex, Turner Road, Lahore, has issued a crucial directive aimed at mitigating potential risks associated with the operations of Payroll Sections. This directive emphasizes the adherence to established job descriptions, standard operating procedures (SOPs), and codal formalities essential for processing computerized Pay Rolls and contingent payments.

Ensuring Compliance and Operational Efficiency

To enhance operational efficiency and compliance, the following directives have been reissued to remind all stakeholders of their responsibilities:

- Adherence to Comprehensive Processes: All concerned parties must strictly comply with the comprehensive process outlined for the submission of bills, maintenance of Bill Transit Register, receipt of cheques, and preparation of passed bill statements for cheque issuance, as detailed in Office Order No. TM-1/209 dated 06.12.2017.

- Job Descriptions: Job descriptions for Junior Auditors, Senior Auditors, Assistant Accounts Officers, and Accounts Officers in the Pay Rolls Sections, as circulated under Office Order No. TM-1/46 dated 03.03.1999 (last amended by O.O. No.PR(C)/05 dated 18.12.2020), must be strictly adhered to. These roles define the responsibilities and scope of each position, ensuring clarity and efficiency in payroll operations.

- Role of Supporting Staff: The job descriptions for all tiers and supporting staff roles, as detailed in Office Orders No. TM-1/46 dated 03.03.1999, O.O. No. TM-1/209 dated 06.12.2017, and amended under O.O. No. TM-1/226 dated 27.08.2020, should be diligently followed. Periodical circulars and letters will continue to be issued to departmental authorities for reconciling expenditures, following directives issued to Principal Accounting Officers under No. DAC(C) S.W/Reconciliation/SPL//HM/699 dated 02.01.2019 and Office Order No. TM-1/231 dated 08.03.2020. Monthly Civil Accounts figures must include reconciliation statements to ensure accuracy and accountability.

- Codal Formalities and Pre-Audit Checks: All codal formalities and pre-audit checks must be strictly observed when processing claims from the Government of Punjab against approved budgetary provisions. This ensures that all payments are made in accordance with authorized expenditures, preventing unauthorized transactions and ensuring fiscal discipline.

- Enhanced Internal Controls: While the responsibility for record-keeping rests with Senior Auditors, ultimate accountability now lies with Assistant Accounts Officers and Accounts Officers of the respective sections and District Accounts Officers (DAOs). Sectional Heads, including Accounts Officers and DAOs, are instructed to maintain stringent internal controls to prevent fraud and mismanagement in salary and contingency payments.

This directive, approved by the Accountant General Punjab under No. TM-1/2-5/Part File/2018-20/2087, underscores the importance of compliance with established protocols to safeguard financial operations and uphold transparency.

Forwarded for Information and Necessary Action:

- PS to the Director (Establishment), Office of the Controller General of Accounts, CGA Complex, Islamabad.

- SPS to Accountant General, Punjab, Lahore.

- PS to Director General (DA).

- The Additional Accountant General/Admn, Pay Rolls.

- All Deputy Accountant Generals.

- All District Accounts Officers in Punjab/T.O. Lahore.

- All officers in the Main Office.

- All Sections in the Main Office.

- Accounts Officer Incharge, H.R. Lab (Local).

- Assistant Accountant General, Website Cell.

- I.CO. (for kind information of Accountant General, Punjab).

By reinforcing these directives, the Office of the Accountant General Punjab aims to streamline operations, mitigate risks, and ensure the efficient management of payroll processes in line with governmental guidelines and best practices.