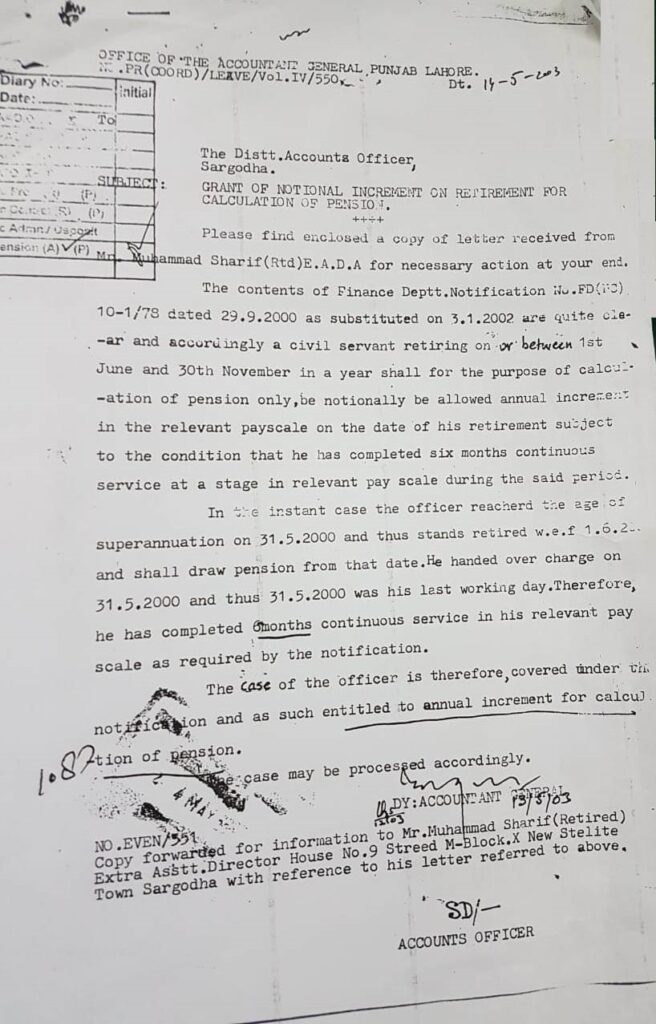

Notional Increment on Retirement for Calculation of Pension -AG – 14.05.2003

OFFICE MEMORANDUM

Subject: Notional Increment on Retirement for Calculation of Pension

Please find enclosed a copy of letter received from Pension (A)V(P) Mr. Muhammad Sharif E.A.D.A for necessary action at your end.

The contents of Finance Department Notification No. FD (FC). 10-1/78 dated 29.9.2000 as substituted on 3.1.2002 are quite clear and accordingly a civil servant retiring on or between 1st June and 30th November in a year shall for the purpose of calculation of pension only, be notionally be allowed annual increment in the relevant pay scale on the date of his retirement subject to the condition that he has completed six months continuous service at a stage in relevant pay scale during the said period. In the instant case the officer reached the age of superannuation on 31.5.2000 and thus stands retired W.E.F 1.6.2. and shall draw pension from that date. He handed over charge on 31.05.2000 and thus 31.5.2000 was his last working day. Therefore, he has completed months continuous service in his relevant pay scale as required by notification.

The case of the officer is therefore, covered under the notification and as such entitled to annual increment for calculation of pension.

The concept of Notional Increment on Retirement for calculating pensions is an important aspect in some government or public sector pension schemes. Let’s break it down simply, with reference to an order issued on 14th May 2003 by the Accountant General (AG).

What is a Notional Increment?

A notional increment refers to an assumed or theoretical salary increase given for the purpose of pension calculations, even though the employee may not have actually received that increment before retiring. It’s used to ensure fairness in calculating the final pension, especially in situations where the employee retired right before their next salary increment date.

Why is it Important for Pension Calculation?

Pensions are often calculated based on the last drawn salary of the employee, which usually includes basic pay plus any increments they received during their service. If an employee retires just before their annual increment, their pension may be lower than it would have been had they continued working to receive the increment. To address this, the idea of notional increment was introduced.

For example, let’s say an employee retires on 30th June, but their salary increment is due on 1st July. In this case, they technically didn’t receive that increment before retirement. However, under notional increment rules, they are assumed to have received that increment on 1st July, and their pension is calculated based on this increased salary.

The AG Order of 14th May 2003

The order issued by the Accountant General on 14th May 2003 relates to this concept, providing specific guidelines for the use of notional increments in pension calculations for retiring employees. It clarifies when and how the notional increment can be applied.

This order was particularly useful for employees who retired shortly before their next salary increment, ensuring that they received a fair pension based on the salary they would have received if they had continued working a little longer. In some cases, this may even apply to promotions or other benefits that an employee was close to receiving but couldn’t due to their retirement date.

Conditions for Granting Notional Increment

According to the guidelines from this and similar orders, certain conditions need to be met for an employee to be granted a notional increment:

- The employee must have been close to their next salary increment date.

- The increment is only theoretical for the purpose of pension calculations and does not affect the employee’s actual last drawn salary.

- The order may apply differently based on the specific rules of the organization or government sector.

Conclusion

The concept of notional increment helps ensure that employees retiring shortly before their annual increment do not suffer financially when it comes to their pension. The AG’s order of 14th May 2003 provides clear guidelines for implementing this, ensuring fairness and preventing employees from losing out on their rightful pension amount due to the timing of their retirement.

This system aims to protect the financial interests of retirees by giving them a pension calculated as if they had continued in service until their next scheduled increment, providing a small but meaningful increase in their retirement benefits.