Micro Payment Gateway Implantation – IBAN – AG dt 18.07.2024- IBAN – AG dt 18.07.2024

OFFICE MEMORANDUM

Subject: Micro Payment Gateway Implantation – IBAN

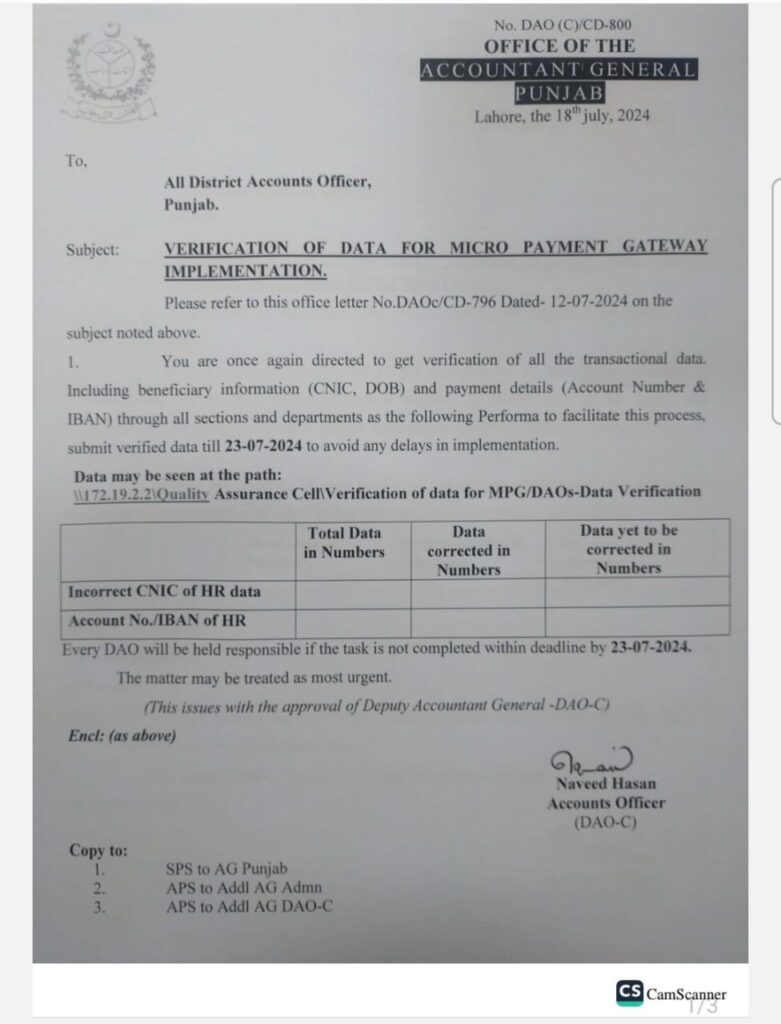

Please refer to this office letter No. DAO/CD-796 Dated- 12-07-2024 on the subject noted above.

- You are once again directed to get verification of all the transactional data. Including beneficiary information (CNIC, DOB) and payment details (Account Number & IBAN) through all sections and departments as the following Performa to facilitate this process, submit verified data till 23-07-2024 to avoid any delays in implementation.

Data may be seen at the path

172.19.2.2 Quality Assurance Cell Verification of data for MPG/DAOS-Data Verification

| Total Data in Numbers | Data corrected in numbers | Data yet to be corrected in Numbers | |

| Incorrect CNIC of HR data | |||

| Account No./IBAN of HR |

Every DAO will be held responsible if the task is not completed within deadline by 23-07-2024.

The matter may be treated as most urgent.

A Micro Payment Gateway Implementation is a system designed to handle small-scale online transactions efficiently. Let’s break down the key components of this topic, including IBAN and the significance of the AG dated 18.07.2024.

What is a Micro Payment Gateway?

A micro payment gateway is a technology that processes small payments, usually below $10. It is commonly used in industries where users need to make frequent, low-value purchases, such as online games, digital content, or app stores. Traditional gateways might charge high fees, making them impractical for small transactions. Micro payment gateways are optimized to keep these fees as low as possible, making small payments viable.

How it Works

A micro payment gateway enables the seller to receive payments quickly and securely. Here’s how the process usually works:

- Customer Initiates Payment: When a customer wants to buy something online, they provide their payment details (like card info or bank details).

- Gateway Process: The payment gateway securely transfers the customer’s information to the bank or payment provider.

- Verification: The bank or payment provider verifies the customer’s identity and checks if they have enough funds.

- Transaction Approval: If the details are correct, the transaction is approved, and the money is transferred from the customer to the merchant.

For micro payments, the focus is on speeding up this process and minimizing fees. Technologies like one-click payments or stored payment information are often used.

The Role of IBAN

The IBAN (International Bank Account Number) is an internationally recognized standard for identifying bank accounts across borders. It’s essential for international transactions, especially in European countries. When implementing a micro payment gateway, using an IBAN ensures that users can send and receive payments globally without errors.

An IBAN consists of:

- Country code: The first two letters signify the country.

- Check digits: The next two numbers help ensure the IBAN is valid.

- Bank and Account Details: The rest of the digits represent the specific bank and account.

When you set up a micro payment gateway, having IBAN integration allows users to connect their international bank accounts for small payments, ensuring that they can send and receive money without complications.

AG Dated 18.07.2024

“AG” typically refers to Aktiengesellschaft, a German term for a public limited company. The date provided, 18.07.2024, could refer to a policy or legal development related to the implementation of micro payment gateways or new regulations concerning IBAN usage in micro payments. This could include new rules for public companies using micro payment systems, ensuring security and compliance with banking regulations.

In July 2024, these regulations may have introduced enhancements to existing systems, such as making it mandatory for companies to adopt secure IBAN-based payment methods for transparency and fraud prevention. Companies may also need to follow stricter data security measures to protect user payment information.

Conclusion

In summary, a Micro Payment Gateway Implementation revolves around providing an efficient, cost-effective way to process small transactions online. Incorporating IBAN into these systems allows for global transactions, making it easy for users to pay from anywhere in the world. The potential legal and regulatory changes, such as those dated 18.07.2024, could ensure companies implement secure and compliant payment solutions, particularly for international transactions. As businesses and technology evolve, micro payment gateways will likely become even more streamlined and accessible, helping both customers and businesses engage in secure, small-scale online transactions.