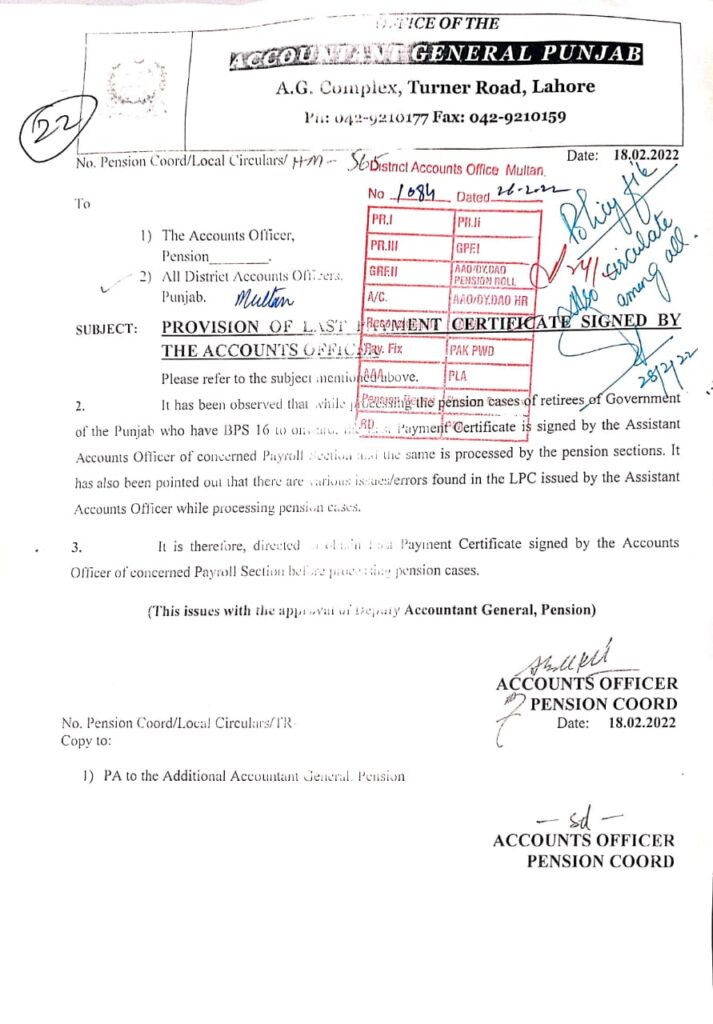

Last Payment Certificate LPC signed by the Account Officer –AG 18.02.2022

The Last Payment Certificate (LPC) is a crucial document in the process of retirement for government employees. Issued at the end of an employee’s service, the LPC serves as a final statement of the payments made to the employee and is an essential requirement for the processing of pension claims. The recent directive from the Accountant General dated 18.02.2022 emphasizes the need for this certificate to be signed by the Accounts Officer rather than an Assistant Accounts Officer. This change aims to enhance the accuracy and integrity of the LPC issuance process, addressing issues observed in previous practices.

The Significance of LPC in Pension Processing

What is a Last Payment Certificate (LPC)?

An LPC is a formal statement issued by a government department confirming that all dues and payments to an employee have been settled up to the date of their retirement. This certificate is essential for the processing of a pension claim and ensures that the retiree receives their entitled benefits without discrepancies.

Why is LPC Critical for Pension Claims?

- Verification of Dues: The LPC verifies that all payments made to the retiring employee, including salary and allowances, are correct. It acts as a final audit document ensuring that no outstanding payments or errors exist.

- Processing Pension Claims: The LPC is a prerequisite for the processing of pension claims. It provides the necessary documentation that pension sections use to calculate and disburse pension benefits.

- Ensuring Financial Integrity: By detailing the final payments, the LPC helps maintain financial integrity and accountability in government financial management. It ensures that all dues are settled before the employee’s retirement benefits are processed.

Key Issues Identified in LPC Issuance

The AG 18.02.2022 directive highlights several issues with LPCs issued by Assistant Accounts Officers, including errors that affect pension processing. Common problems include:

- Errors in Payment Details: LPCs issued by Assistant Accounts Officers sometimes contain errors in the payment details, leading to discrepancies in the pension claims.

- Inaccurate Documentation: Mistakes in documentation can delay pension processing and affect the retiree’s ability to receive timely benefits.

- Lack of Authority: Assistant Accounts Officers may lack the authority required to verify and sign off on LPCs, leading to potential issues with the validity of the certificate.

The New Directive: AG 18.02.2022

The Accountant General’s directive of 18.02.2022 introduces a significant change in the LPC issuance process. Here are the main points of the directive and their implications:

What Does the Directive Specify?

The directive mandates that the LPC must be signed by the Accounts Officer instead of the Assistant Accounts Officer. This change is aimed at addressing the issues identified in previous practices and ensuring a higher level of accuracy and accountability in the issuance of LPCs.

Why is a Change to the Accounts Officer Necessary?

- Enhanced Accuracy: The Accounts Officer, being a higher authority, is expected to provide more accurate and reliable certification compared to the Assistant Accounts Officer.

- Increased Accountability: By requiring the Accounts Officer’s signature, the directive increases the accountability of the LPC issuance process, ensuring that all necessary checks are completed.

- Prevention of Errors: The involvement of the Accounts Officer helps prevent errors in the LPC, which can affect the pension processing and the retiree’s benefits.

Implementation of the Directive

To comply with the directive, the following steps are required:

- LPC Issuance Process: All LPCs must now be reviewed and signed by the Accounts Officer. This step ensures that the final payment details are accurate and complete.

- Training and Awareness: Accounts Officers need to be trained on the new LPC procedures to ensure they understand their responsibilities and the importance of accuracy in the LPC issuance process.

- Monitoring and Compliance: Regular audits and checks should be conducted to ensure that the directive is followed and that LPCs are issued correctly.

Best Practices for LPC Issuance

To meet the requirements of the AG 18.02.2022 directive and ensure the effective processing of pension claims, here are some best practices for the LPC issuance process:

- Thorough Verification: Accounts Officers should thoroughly verify all payment details and ensure that all dues are settled before signing the LPC.

- Accurate Documentation: Ensure that all documents related to the LPC are accurate and complete. This includes verifying payment records, checking for any discrepancies, and ensuring that all required signatures and approvals are obtained.

- Regular Training: Accounts Officers should receive regular training on the LPC issuance process and any updates to procedures or regulations.

- Effective Communication: Maintain open lines of communication between the Accounts Office and the pension section to address any issues or questions related to LPCs promptly.

Challenges and Solutions

Challenges in LPC Issuance

- Resistance to Change: Implementing changes to established procedures can face resistance from staff accustomed to old practices.

- Training Gaps: Ensuring that all Accounts Officers are trained on the new LPC procedures can be challenging, particularly in large organizations.

Solutions

- Change Management: Implement a structured change management plan to address resistance and guide staff through the new procedures.

- Comprehensive Training Programs: Develop and conduct comprehensive training programs for Accounts Officers to ensure they are well-versed in the new LPC requirements.

Conclusion

The AG 18.02.2022 directive marks a significant step forward in improving the LPC issuance process for government pensions. By mandating that the LPC be signed by the Accounts Officer rather than the Assistant Accounts Officer, the directive aims to enhance accuracy, accountability, and integrity in the pension processing system.

By understanding the importance of the LPC, recognizing the issues with previous practices, and implementing the best practices outlined in the directive, government departments can ensure that pension claims are processed efficiently and accurately. This change not only benefits retiring employees but also strengthens the overall financial management framework within the government.