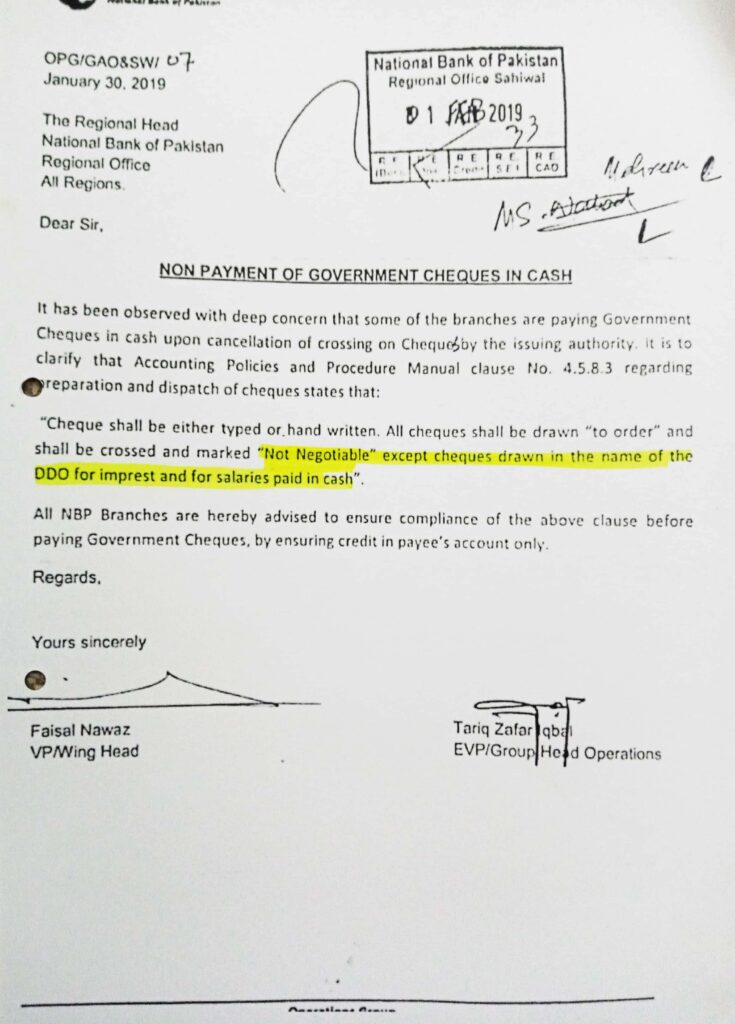

Non Payment of Government Cheques in cash dt 01.01.2019

On January 1, 2019, the office of the Regional Head of the National Bank of Pakistan issued a directive emphasizing the crucial importance of adhering to established accounting policies regarding the handling of government cheques. This directive was prompted by growing concerns about some branches paying out government cheques in cash after the cancellation of crossing by the issuing authority. This practice contravenes the guidelines set forth in the Accounting Policies and Procedure Manual. The directive aims to reinforce the proper procedures for cheque issuance and payment, ensuring transparency, accountability, and compliance with regulatory standards.

Understanding the Directive

The directive addressed to all regions, including the Sahiwal Regional Office, highlights a key clause from the Accounting Policies and Procedure Manual (Clause No. 4.5.8.3). This clause explicitly states that all government cheques must be either typed or handwritten, drawn “to order,” crossed, and marked “Not Negotiable.” The only exceptions to this rule are cheques drawn in the name of the Drawing and Disbursing Officer (DDO) for imprest funds and salaries paid in cash. The directive mandates that all National Bank of Pakistan (NBP) branches ensure compliance with this clause before disbursing any government cheques.

The Importance of Compliance

Ensuring compliance with this directive is vital for several reasons. First, it upholds the integrity of financial transactions involving government funds. By mandating that cheques be crossed and marked “Not Negotiable,” the directive minimizes the risk of fraud and misappropriation of government funds. It ensures that cheques are credited directly to the payee’s account, providing a clear audit trail and enhancing accountability.

Second, compliance with the directive aligns with best practices in financial management. Crossed cheques that are “Not Negotiable” cannot be cashed over the counter, reducing the likelihood of unauthorized or improper payments. This practice promotes the secure transfer of funds and helps maintain public trust in the financial system.

Challenges and Solutions

Despite the clear benefits of compliance, some branches have struggled to adhere to the directive. The reasons for this non-compliance may vary, including a lack of awareness about the policy, procedural inefficiencies, or the perceived convenience of cash payments. To address these challenges, the following solutions can be implemented:

- Training and Awareness Programs: Conducting regular training sessions for branch staff to familiarize them with the directive and its importance can enhance compliance. These programs should emphasize the risks associated with non-compliance and the benefits of adhering to the established procedures.

- Strengthening Internal Controls: Branches should review and strengthen their internal controls to ensure that all government cheques are processed in accordance with the directive. This may involve updating standard operating procedures, enhancing oversight mechanisms, and conducting periodic audits.

- Technological Integration: Leveraging technology to automate and streamline cheque processing can minimize human error and ensure compliance. Implementing robust software solutions that enforce the directive’s guidelines can enhance efficiency and reduce the risk of non-compliance.