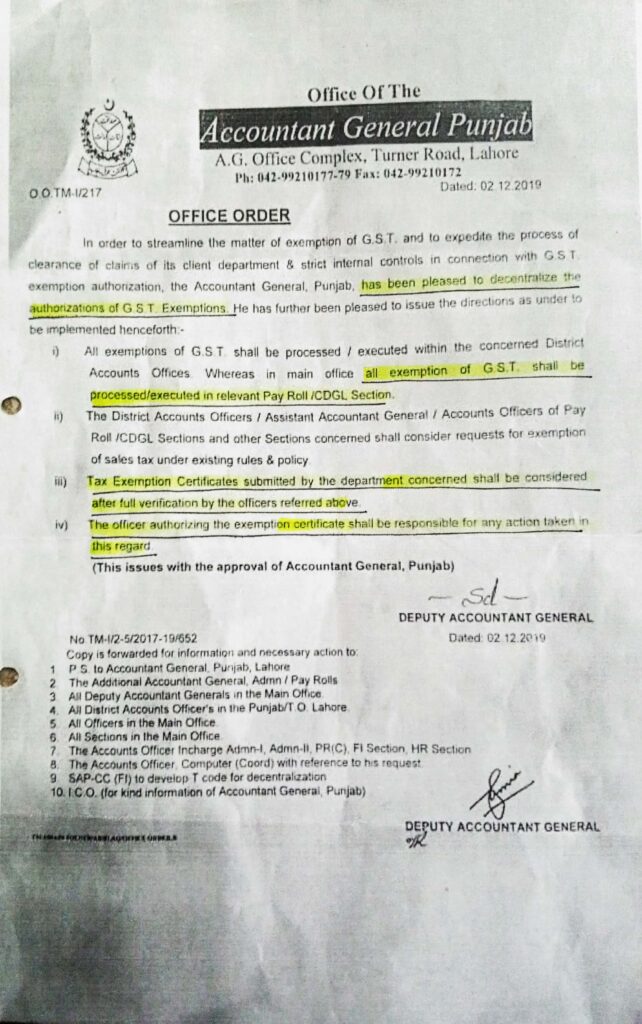

Decentralization of GST Exemption -AG dt 02.12.2019

The Accountant General Punjab has implemented a significant policy shift aimed at streamlining and expediting the process of GST exemption. This decentralization initiative ensures more efficient processing of GST exemption claims by delegating authority to relevant district and main office sections. By doing so, the policy aims to enhance transparency, accountability, and effectiveness in managing GST exemption authorizations.

Background

The General Sales Tax (GST) exemption process has historically been centralized, leading to delays and inefficiencies in handling exemption claims. Recognizing the need for a more responsive and agile system, the Accountant General Punjab has decentralized the authorization process. This change is designed to empower local offices and sections, thereby reducing bureaucratic bottlenecks and accelerating the clearance of claims.

Key Directives

The decentralization of GST exemption authorizations comes with specific directives to ensure smooth implementation and compliance. The following are the primary directives issued:

- Decentralized Processing and Execution: All GST exemptions are to be processed and executed within the concerned District Accounts Offices (DAOs). In the main office, the relevant Pay Roll/CDGL Section will handle the exemptions. This decentralization allows for more localized and efficient handling of exemption requests.

- Adherence to Existing Rules and Policies: The District Accounts Officers (DAOs), Assistant Accountant General, Accounts Officers of Pay Roll/CDGL Sections, and other relevant sections must consider requests for GST exemption in strict accordance with existing rules and policies. This ensures that all exemptions are granted based on established guidelines, maintaining consistency and fairness.

- Verification of Tax Exemption Certificates: Tax Exemption Certificates submitted by the concerned departments must undergo full verification by the designated officers. This step is crucial to prevent fraudulent claims and ensure that only legitimate requests are processed.

- Accountability of Authorizing Officers: The officer responsible for authorizing the exemption certificate will be held accountable for any actions taken in this regard. This directive ensures that officers exercise due diligence and uphold the highest standards of integrity when processing GST exemption claims.

Implementation Strategy

The implementation of the decentralization policy involves several key steps:

- Training and Capacity Building: Officers in district and main offices will undergo training to familiarize themselves with the new processes and responsibilities. This training will cover the technical aspects of GST exemption processing, verification procedures, and compliance with existing policies.

- Development of New T Codes: The SAP-CC (FI) is tasked with developing new T codes to facilitate the decentralization process. These codes will enable efficient tracking and management of exemption claims, ensuring that all transactions are transparent and auditable.

- Communication and Coordination: Clear communication channels will be established between the main office and district offices to ensure seamless coordination. Regular updates and feedback mechanisms will be put in place to address any challenges and continuously improve the process.

- Monitoring and Evaluation: The implementation of the decentralization policy will be closely monitored to assess its effectiveness. Key performance indicators (KPIs) will be established to measure processing times, accuracy of exemptions granted, and overall efficiency of the system. Regular evaluations will help identify areas for improvement and ensure that the objectives of the policy are met.

Expected Benefits

The decentralization of GST exemption authorizations is expected to yield several benefits:

- Faster Processing Times: By delegating authority to local offices, the time required to process GST exemption claims will be significantly reduced. This will enable quicker clearance of claims and timely disbursement of funds.

- Improved Accountability: Holding officers accountable for their actions in the authorization process will enhance transparency and reduce the risk of fraudulent claims. This accountability ensures that all exemptions are granted based on merit and in compliance with established guidelines.

- Enhanced Efficiency: Localized processing allows for more efficient handling of exemption requests, as officers closer to the source of the claim can address issues more promptly. This improved efficiency will lead to better service delivery and increased satisfaction among stakeholders.

- Empowerment of Local Offices: Decentralizing the process empowers district and main office sections, giving them greater responsibility and control over GST exemption authorizations. This empowerment fosters a sense of ownership and encourages proactive management of exemption claims.

Conclusion

The decentralization of GST exemption authorizations marks a significant step towards enhancing the efficiency, transparency, and accountability of the exemption process. By empowering local offices and streamlining procedures, the Accountant General Punjab aims to provide better service to its client departments and ensure timely clearance of GST exemption claims. This policy change reflects a commitment to continuous improvement and responsiveness in public service delivery.