Conveyance Allowance during Training and Study Leave 10.02.2016

Conveyance allowance, a vital component of government employee benefits, often prompts numerous queries regarding its applicability under various circumstances. One such scenario pertains to its eligibility during training or study leave, particularly when such leave is undertaken abroad. A recent examination by the Finance Department has shed light on this matter, leading to a definitive stance. This article delves into the details surrounding the conveyance allowance during training and study leave, as clarified by the Finance Department.

Background of Conveyance Allowance

Conveyance allowance is designed to cover the transportation costs incurred by employees commuting to and from their workplace. It is a standard benefit provided to ensure that employees are not financially burdened by their daily travel expenses. The allowance varies depending on the employee’s grade and the specific policies of the governing body.

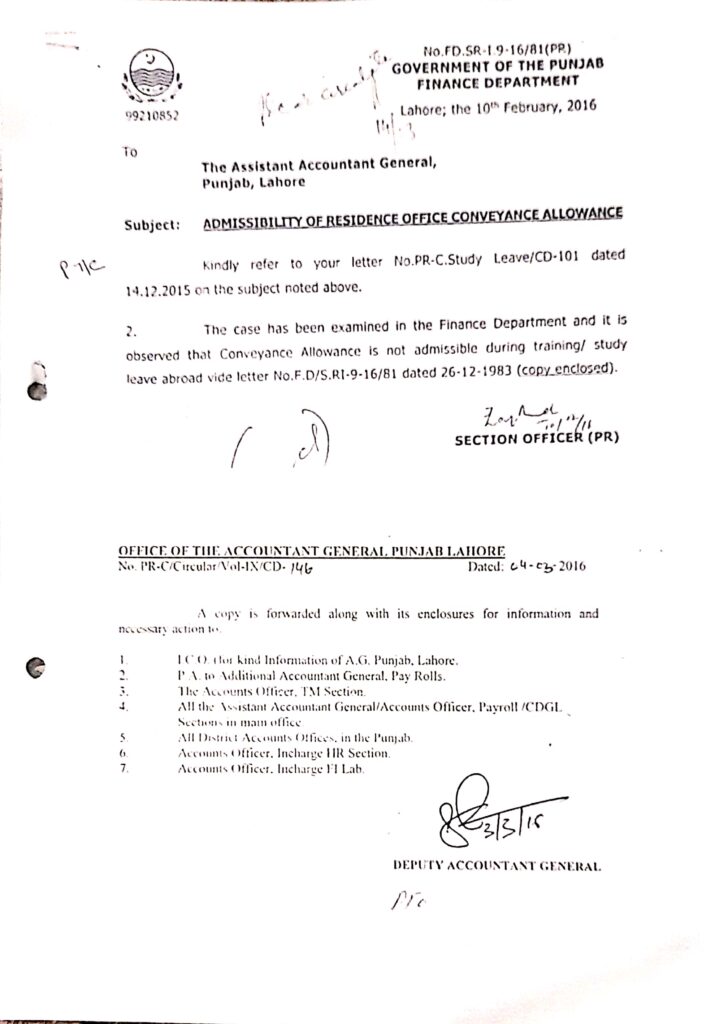

Reference to Previous Communication

The matter at hand was brought to attention through a letter (No.PR-C.Study Leave/CD-101) dated December 14, 2015, which sought clarification on the admissibility of conveyance allowance during periods of training or study leave. The request necessitated a thorough review by the Finance Department to ensure compliance with existing regulations and policies.

Finance Department’s Examination

Upon careful examination of the case, the Finance Department referred to the established guidelines as per letter No.F.D/S.RI-9-16/81 dated December 26, 1983. According to these guidelines, conveyance allowance is explicitly deemed inadmissible during training or study leave when undertaken abroad. This conclusion aligns with the broader intent and application of conveyance allowances, which are intended to subsidize daily commutes rather than travel expenses related to training or educational pursuits outside the country.

Key Points from the Finance Department’s Observation

- Non-Admissibility During Training/Study Leave Abroad: The Finance Department’s scrutiny revealed that conveyance allowance is not permissible for employees on training or study leave abroad. This aligns with the policy established in 1983, which remains effective and binding.

- Consistency in Policy Application: The reiteration of this policy underscores the importance of consistent application across different departments and scenarios. It ensures that the rules are uniformly adhered to, preventing any discrepancies or misinterpretations.

- Reinforcement of Established Guidelines: By referring to the longstanding policy, the Finance Department reinforces the relevance and applicability of historical guidelines in contemporary cases. This approach helps in maintaining continuity and clarity in administrative processes.

Implications for Government Employees

For government employees considering or currently on training or study leave, this clarification holds significant implications:

- Financial Planning: Employees must account for the lack of conveyance allowance during such leaves in their financial planning. This understanding helps in better budgeting and management of personal finances during periods of study or training abroad.

- Policy Awareness: Awareness of such policies is crucial for employees to avoid any unexpected financial shortfalls. It underscores the importance of being well-informed about the various allowances and their conditions.

- Administrative Compliance: Ensuring compliance with these guidelines is critical for administrative departments. It aids in maintaining transparency and uniformity in the disbursement of benefits and allowances.

Conclusion

The clarification issued by the Finance Department regarding the non-admissibility of conveyance allowance during training and study leave abroad underscores the importance of adherence to established policies. This decision, rooted in guidelines dating back to 1983, reinforces the consistency and continuity of administrative practices. Government employees must take note of these regulations to effectively manage their finances during such leaves, ensuring they are well-prepared for the financial implications.

The Finance Department’s commitment to examining and upholding these policies highlights the importance of clarity and uniformity in the application of employee benefits. By understanding and adhering to these guidelines, employees and administrative bodies can work together to ensure a smooth and transparent operational framework.