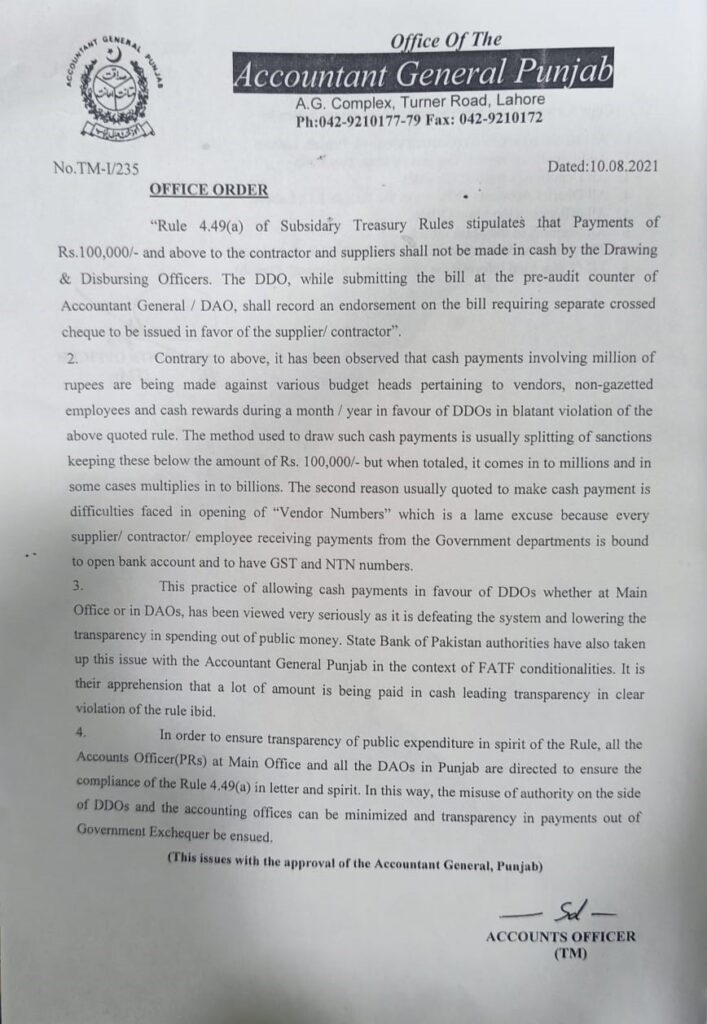

Cash Payment of Rs 100,000 and above by DDOs Rule 4.49(a) -AG 10.08.2021

In a recent communication dated August 10, 2021, the Accountant General Punjab has underscored the significance of adhering to Rule 4.49(a) of the Subsidiary Treasury Rules, which governs cash payments of Rs. 100,000 and above. This rule is crucial in maintaining financial integrity and transparency in the government’s expenditure processes. Here’s a comprehensive look at this rule, its implications, and how to ensure compliance for transparent and effective financial management.

What Does Rule 4.49(a) State?

Rule 4.49(a) stipulates that cash payments of Rs. 100,000 or more to contractors and suppliers should not be made directly by Drawing and Disbursing Officers (DDOs). Instead, the DDO must submit a bill at the pre-audit counter of the Accountant General / DAD and record an endorsement on the bill. This endorsement requires that a separate crossed cheque be issued in favor of the supplier or contractor. This rule ensures that large transactions are processed through secure and verifiable channels rather than cash payments, which can be susceptible to misuse.

The Importance of Compliance with Rule 4.49(a)

Adhering to Rule 4.49(a) is essential for several reasons:

- Prevention of Financial Mismanagement: By mandating that payments over Rs. 100,000 be made through crossed cheques, the rule mitigates the risks associated with cash transactions, such as fraud, embezzlement, or accounting errors.

- Enhanced Accountability: The requirement for a cheque ensures a clear paper trail for large transactions. This traceability promotes accountability among DDOs and reduces the likelihood of financial mismanagement.

- Regulatory Compliance: Following Rule 4.49(a) aligns with regulatory standards set by the State Bank of Pakistan and other financial oversight bodies, thereby meeting FATE conditionalities and other audit requirements.

- Improved Transparency: Requiring cheques for large payments enhances transparency in government transactions, ensuring that public funds are handled with integrity and in accordance with established financial procedures.

Common Violations of Rule 4.49(a)

Despite its importance, there have been notable violations of Rule 4.49(a), which have raised concerns among financial oversight authorities:

- Splitting of Sanctions: One prevalent method of circumventing Rule 4.49(a) is by splitting sanctions into amounts less than Rs. 100,000. This practice allows DDOs to make multiple cash payments, collectively exceeding Rs. 100,000, without triggering the rule’s requirements. This tactic undermines the intent of the rule and circumvents the financial control mechanisms designed to ensure transparency.

- Excuses for Cash Payments: Some DDOs claim difficulties in opening Vendor Numbers as a reason for cash payments. This excuse is invalid as all suppliers, contractors, and employees should already have bank accounts, GST, and NTN numbers for their transactions with government departments.

- Misuse of Discretionary Powers: There have been instances where DDOs have used their discretionary powers to approve cash payments for large sums, which violates the established procedures of Rule 4.49(a).

Addressing Violations and Ensuring Compliance

To address these issues and ensure compliance with Rule 4.49(a), the Accountant General Punjab has issued clear directives to all Accounts Officers and DAOs in Punjab:

- Strict Adherence to Rule 4.49(a): All financial officers are instructed to follow Rule 4.49(a) meticulously. This includes rejecting any attempts to make cash payments that exceed Rs. 100,000 and ensuring that all such payments are processed through crossed cheques.

- Monitoring and Audits: Regular monitoring and audits will be conducted to detect any breaches of Rule 4.49(a). This proactive approach will help identify issues early and ensure that corrective actions are taken promptly.

- Training and Awareness: It is imperative to educate DDOs and financial officers about the importance of Rule 4.49(a) and the consequences of non-compliance. Training programs and workshops can be effective tools for raising awareness and reinforcing the principles of financial transparency and accountability.

- Reporting Mechanisms: Establishing robust reporting mechanisms for violations of Rule 4.49(a) will help in addressing issues transparently. DDOs and financial officers must report any difficulties they face in adhering to the rule to the appropriate supervisory authorities.

Best Practices for Compliance with Rule 4.49(a)

To ensure effective implementation of Rule 4.49(a), DDOs and financial officers should adopt the following best practices:

- Adhere to Financial Procedures: Ensure that all transactions involving amounts greater than Rs. 100,000 are processed through crossed cheques. Familiarize yourself with the detailed procedures for recording and processing such payments.

- Avoid Sanction Splitting: Do not split sanctions to evade the requirements of Rule 4.49(a). Maintain transparency in all financial transactions and follow the established guidelines for handling large payments.

- Maintain Accurate Records: Keep detailed and accurate records of all transactions, including copies of cheques, payment vouchers, and related documents. This practice ensures that all transactions are traceable and auditable.

- Follow Up on Vendor Registrations: Address issues related to vendor registrations promptly. Ensure that all contractors, suppliers, and employees have the necessary bank accounts, GST, and NTN numbers for processing payments.

- Report Issues Promptly: If you encounter challenges in adhering to Rule 4.49(a), report them immediately to your supervisory authorities. Seek guidance on resolving any difficulties and document all communications and resolutions.

Conclusion

Rule 4.49(a) of the Subsidiary Treasury Rules plays a crucial role in ensuring the integrity and transparency of large cash transactions in government operations. By enforcing this rule, the Accountant General Punjab aims to prevent financial mismanagement, enhance accountability, and uphold the principles of public expenditure transparency.

DDOs and financial officers must adhere strictly to Rule 4.49(a), avoiding common pitfalls such as sanction splitting and invalid excuses for cash payments. Through diligent compliance, regular audits, and effective reporting, we can uphold the highest standards of financial management and ensure that public funds are utilized appropriately.

This directive has been issued with the approval of the Accountant General Punjab, highlighting its importance in maintaining transparency and accountability in government financial practices.