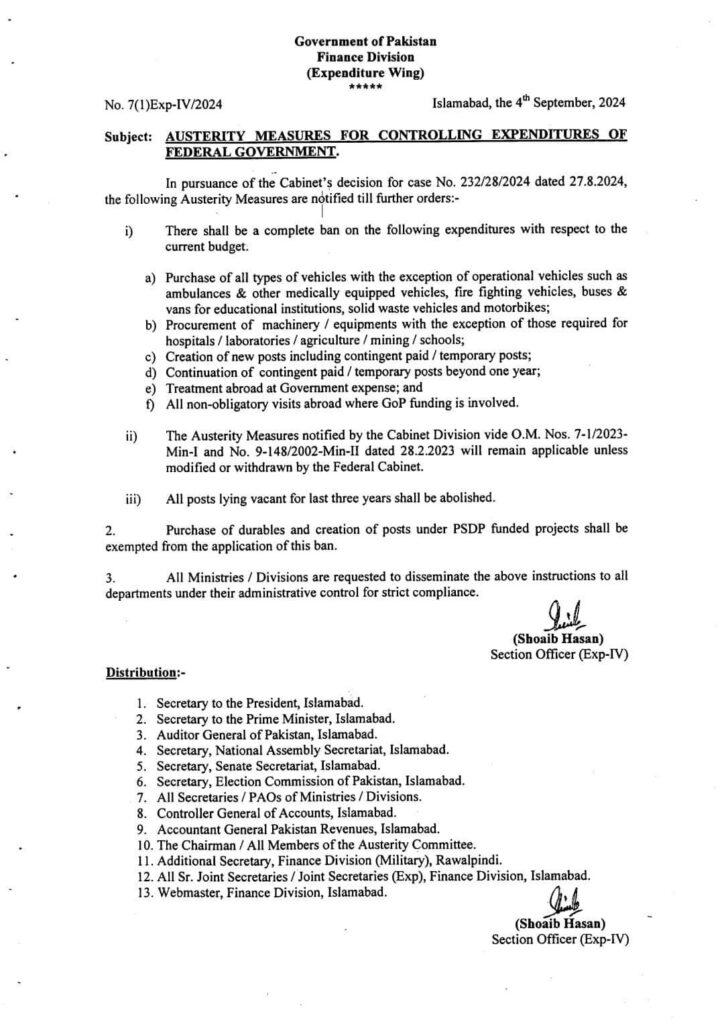

Austerity Measures For Controlling Expenditures Of Federal Government- 04.09.2024

OFFICE MEMORENDUM

Subject: Austerity Measures For Controlling Expenditures Of Federal Government.

In pursuance of the Cabinet’ decision for case No. 232/28/2024 dated 27.8.2024,

The following Austerity Measures are notified till further orders:

i. There shall be a complete ban on the following expenditures with respect to the current budget.

- Purchase of all types of vehicles with the exception of operational vehicles such as ambulances & other medically equipped vehicles, fire fighting vehicles, buses & vans for educational institutions, solid waste vehicles and motorbikes;

- Procurement of machinery I equipment with the exception of those required for hospitals I laboratories I agriculture I mining I schools:

- Creation of new posts including contingent paid I temporary posts;

- Continuation of contingent paid I temporary posts beyond one year;

- Treatment abroad at Government expense; and

- All non-obligatory visits abroad where GOP funding is involved.

ii. The Austerity Measures notified by the Cabinet Division vide O.M. Nos. 7-1/2023- Min-I and No. 9-148/2002-Min- 11 dated 28.22023 will remain applicable unless modified or withdrawn by the Federal Cabinet.

iii. All posts lying vacant for last three years shall be abolished.

2. Purchase of durables and creation of posts under PSDP funded projects shall be exempted from the application of this ban.

3. All Ministries I Divisions are requested to disseminate the above instructions to all departments under their administrative control for strict compliance.

What are Austerity Measures?

Austerity measures are policies that governments use to reduce their spending and manage their budget. These measures are usually implemented during times of economic trouble to help control debt and deficits.

Why Implement Austerity?

Governments might turn to austerity measures when they are facing high levels of debt or when their budget is out of balance. The idea is to make sure they don’t spend more money than they are bringing in.

Common Austerity Measures

- Spending Cuts: Reducing government spending on various programs and services. For example, cutting funding for education, healthcare, or public transportation.

- Tax Increases: Raising taxes to increase government revenue. This could involve increasing income tax rates, sales taxes, or other types of taxes.

- Wage Freezes: Not allowing wages for public sector employees to increase, or even reducing wages.

- Pension Reforms: Changing the rules for pensions to reduce the amount the government has to pay out. This might involve raising the retirement age or reducing benefits.

- Subsidy Reductions: Cutting back on government subsidies for businesses or individuals. For example, reducing financial support for certain industries or sectors.

Pros and Cons

Pros:

- Helps reduce government debt and deficits.

- Can lead to more stable long-term economic conditions.

Cons:

- Can lead to reduced public services and support.

- Might slow down economic growth and lead to higher unemployment.

Example in Action

Imagine a country facing a huge budget deficit. To address this, the government might decide to cut back on funding for various public services, increase taxes, and freeze wages for government employees. While these actions might help balance the budget, they can also lead to public dissatisfaction and reduced services for citizens.

Conclusion

Austerity measures are strategies used by governments to control spending and manage their budgets during economic difficulties. By implementing spending cuts, tax increases, and other reforms, governments aim to reduce debt and deficits. However, while these measures can stabilize the economy and improve long-term financial health, they can also lead to reduced public services and economic challenges in the short term. Balancing the immediate impacts on citizens with long-term economic stability is a crucial aspect of designing and implementing effective austerity policies. Moreover, thoughtful communication and gradual implementation can help mitigate some of the negative impacts on the public.