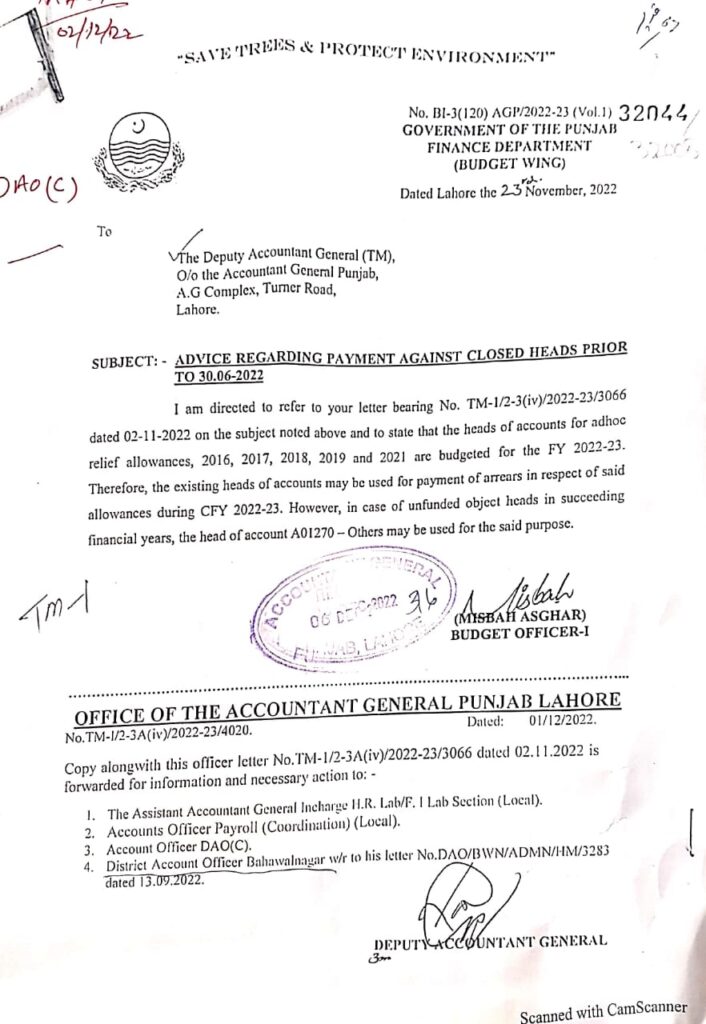

Arrear Payment of Allowances Against Closed Heads dt 23.11.2022

OFFICE MEMORANDUM

Subject: Arrear Payment of Allowances Against Closed Heads

I am directed to refer to your letter bearing No. TM-1/2-3(iv)/2022-23/3066 dated 02-11-2022 on the subject noted above and to state that the heads of accounts for adhoc relief allowances, 2016, 2017, 2018, 2019 and 2021 are budgeted for the FY 2022-23. Therefore, the existing heads of accounts may be used for payment of arrears in respect of said allowances during CFY 2022-23. However, in case of unfunded object heads in succeeding financial years, the head of account A01270-Others may be used for the said purpose.

This letter discusses the payment of arrears (past payments owed) for several types of allowances (extra pay), specifically from the years 2016, 2017, 2018, 2019, and 2021. The letter responds to a previous letter sent on November 2, 2022, and offers instructions on how to handle these payments during the financial year (FY) 2022-23.

Explanation

- Reference to Previous Letter:

The letter you received is a reply to your earlier correspondence (No. TM-1/2-3(iv)/2022-23/3066 dated November 2, 2022). This is important because the instructions provided are based on the information you submitted in that letter. - Subject of the Letter:

The topic is the “Arrear Payment of Allowances Against Closed Heads.” “Closed heads” refer to budget categories that may no longer be active, but payments are still needed for previous allowances. - Budgeting for Arrears:

The allowances for the years 2016, 2017, 2018, 2019, and 2021 are included in the budget for the FY 2022-23. This means that the government has allocated funds for these specific allowances, allowing arrear payments to be made in the current financial year (2022-23). The phrase “existing heads of accounts” refers to the current budget categories used for making payments. These same budget heads can be used to pay off the arrears, simplifying the process. - What to Do in Future Years:

The letter also considers what will happen if there are unfunded object heads in future financial years. “Unfunded object heads” means categories in the budget that don’t have money allocated to them in future years. If there are no specific budget lines for these allowances in future years, the letter gives a solution. It says that in these cases, the head of account “A01270 – Others” should be used. This is a catch-all budget category that allows payments to still be made, even if the usual budget lines are closed or empty.

Breakdown of Key Points:

- Allowances and Arrears: The arrears refer to delayed or unpaid allowances from earlier years (2016, 2017, 2018, 2019, and 2021).

- Budgeted for FY 2022-23: The government has allocated funds in the FY 2022-23 budget for these past allowances. So, during this financial year, the arrears can be paid using the existing budget heads.

- Use of “A01270 – Others”: If there is no specific budget allocation for these allowances in future years, the “A01270 – Others” budget head can be used to pay the arrears.

Conclusion

This letter provides clear instructions on how to handle arrear payments for various allowances. For the financial year 2022-23, the arrears for allowances from 2016, 2017, 2018, 2019, and 2021 can be paid using the current budget categories. The government has already budgeted for this, so there is no need for additional budget approval this year.

However, if these allowances need to be paid in future years and the usual budget heads are not funded, there is a solution in place. The head of account “A01270 – Others” can be used to ensure that the payments can still be made. This allows the organization to maintain flexibility and ensure payments are made without causing delays or confusion.