Payroll Execution Schedule – AG 06.02.2018

In the realm of public service administration, efficient payroll management stands as a cornerstone for ensuring timely and accurate disbursement of salaries to employees. At the heart of this operational efficiency lies SAP Payroll, a robust system that supports the processing of payroll for a vast number of employees across various departments and districts. This directive, issued by the competent authority of the Accountant General Punjab, outlines the meticulous schedule designed to uphold operational priorities and ensure seamless payroll execution.

Importance of Timely Payroll Disbursement

Timely disbursement of salaries is not merely an administrative formality but a critical factor in maintaining employee satisfaction and morale. The payroll system’s ability to accurately calculate and disburse payments on schedule directly impacts the livelihoods of employees, making it imperative for all stakeholders to adhere strictly to the prescribed timelines.

Verification of Master Data and Changes

A pivotal aspect of payroll execution is the verification of master data and any associated changes. This process involves thorough scrutiny through edit lists and trend analysis reports, ensuring that all updates to employee records are accurately reflected. Timely verification mitigates errors and discrepancies, thus maintaining the integrity of the payroll system and enhancing data security.

Monthly Accounts Preparation

Alongside payroll disbursement, another essential function is the timely preparation of monthly accounts. This task involves consolidating financial data related to payroll expenditures, ensuring transparency and accountability in public financial management. Adherence to the stipulated schedule facilitates smooth financial reporting and supports decision-making processes within governmental entities.

Mitigating Technical Risks

Despite the advanced capabilities of SAP Payroll, technical issues can occasionally disrupt operations. The payroll execution schedule includes provisions aimed at minimizing such risks. By aligning activities according to a structured timetable, departments can proactively address potential challenges and maintain operational continuity, thereby safeguarding against delays and ensuring employee satisfaction.

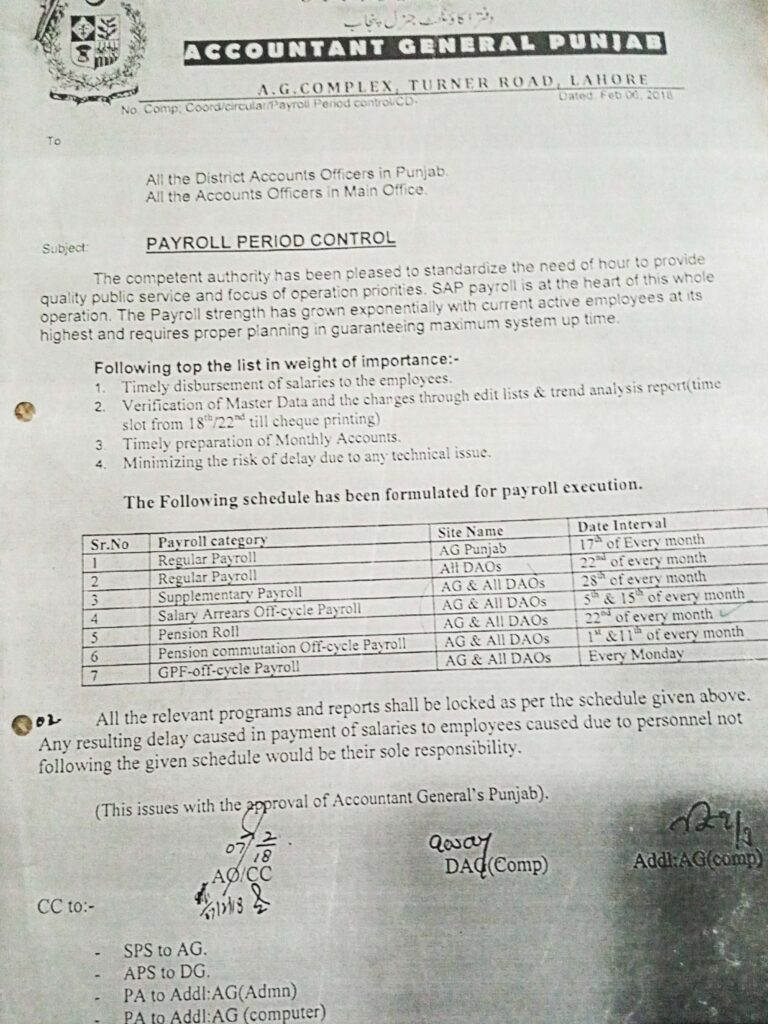

Detailed Schedule for Payroll Execution

- Regular Payroll (17th and 22nd of Every Month):

- The core payroll processing for all regular employees is scheduled to occur twice a month, on the 17th and 22nd. This frequency ensures that employees receive their salaries promptly at predefined intervals.

- Supplementary Payroll (28th of Every Month):

- Supplementary payrolls are executed on the 28th of each month, accommodating additional payments such as bonuses, incentives, or other ad-hoc allowances.

- Salary Arrears Off-cycle Payroll (5th and 15th of Every Month):

- Payrolls addressing salary arrears are processed on the 5th and 15th of every month, addressing any outstanding payments owed to employees from previous periods.

- Pension Roll (22nd of Every Month):

- The pension roll, crucial for retired personnel receiving pension benefits, is processed on the 22nd of each month. This schedule ensures retirees receive their entitlements in a timely manner.

- Pension Commutation Off-cycle Payroll (1st and 11th of Every Month):

- Off-cycle payrolls for pension commutation, which involves converting a portion of pension into a lump-sum payment, are processed on the 1st and 11th of every month.

- GPF-Off-cycle Payroll (Every Monday):

- General Provident Fund (GPF) off-cycle payrolls are executed every Monday, addressing withdrawals or loans against employees’ GPF contributions as per their requests.

Implementation and Compliance

The effective implementation of this payroll execution schedule necessitates strict adherence by all concerned departments, including the Principal Accounting Officers (PAOs), District Accounts Officers (DAOs), and relevant support staff. Compliance ensures that payroll activities proceed seamlessly, avoiding disruptions that could impact employee satisfaction and operational efficiency.

Responsibilities and Accountability

Each level of the organizational hierarchy, from Junior Auditors to Accounts Officers and DAOs, plays a crucial role in ensuring the smooth execution of payroll activities. Clear job descriptions and responsibilities outlined in previous directives provide a framework for operational efficiency and accountability.

Monitoring and Oversight

To uphold the integrity of the payroll process, monitoring mechanisms are essential. Activity logs and user access rights are monitored vigilantly, ensuring that only authorized personnel have access to sensitive payroll data and operations. This proactive approach minimizes the risk of unauthorized access or procedural errors that could compromise data security.

Continuous Improvement

The payroll execution schedule is not static but subject to periodic review and improvement. Feedback from stakeholders, ongoing technological advancements, and changes in regulatory requirements prompt updates to the schedule, enhancing its effectiveness and relevance in a dynamic administrative environment.

Conclusion

In conclusion, the payroll execution schedule issued by the Accountant General Punjab reflects a commitment to operational excellence and employee welfare. By adhering to this structured timetable, governmental entities ensure the timely disbursement of salaries and benefits while mitigating risks associated with payroll management. Continuous adherence to best practices and procedural guidelines underpins the integrity and reliability of payroll operations, fostering trust and efficiency within the public service sector.