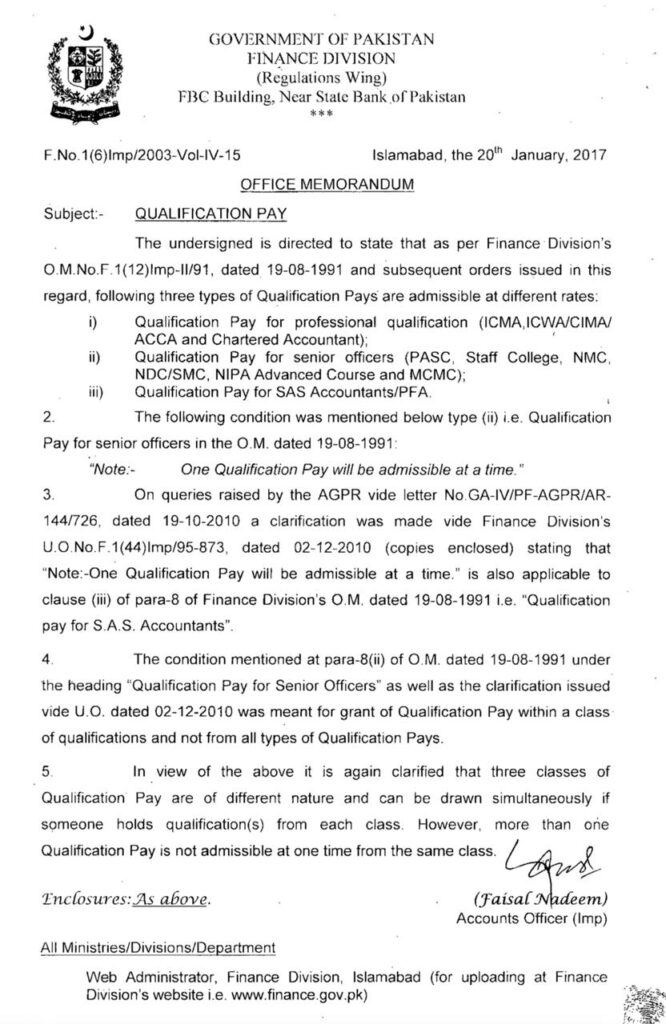

Qualification Pay – Federal dt 20.01.2017

OFFICE MEMORANDUM

Subject: Qualification Pay

The undersigned is directed to state that as per Finance Division’s O.M. No. F.1(12)Imp-II/91, dated 19-08-1991 and subsequent orders issued in this regard, the following three types of Qualification Pays are admissible at different rates:

i) Qualification Pay for professional qualification (ICMA, ICWA, CIMA, ACCA, and Chartered Accountant);

ii) Qualification Pay for senior officers (PASC, Staff College, NMC, NDC/SMC, NIPA Advanced Course, and MCMC);

iii) Qualification Pay for SAS Accountants/PFA.

2. The following condition was mentioned below type (ii) i.e., Qualification Pay for senior officers in the O.M. dated 19-08-1991:“Note: One Qualification Pay will be admissible at a time.”

3. On queries raised by the AGPR vide letter No.GA-IV/PF-AGPR/AR-144/726, dated 19-10-2010, a clarification was made vide Finance Division’s U.O. No. F.1(44)Imp/95-873, dated 02-12-2010 (copies enclosed) stating that “Note: One Qualification Pay will be admissible at a time.” is also applicable to clause (iii) of para-8 of Finance Division’s O.M. dated 19-08-1991 i.e., “Qualification pay for S.A.S. Accountants”.

4. The condition mentioned at para-8(ii) of O.M. dated 19-08-1991 under the heading “Qualification Pay for Senior Officers” as well as the clarification issued vide U.O. dated 02-12-2010 was meant for grant of Qualification Pay within a class of qualifications and not from all types of Qualification Pays.

5. In view of the above, it is again clarified that three classes of Qualification Pay are of different nature and can be drawn simultaneously if someone holds qualification(s) from each class. However, more than one Qualification Pay is not admissible at one time from the same class.