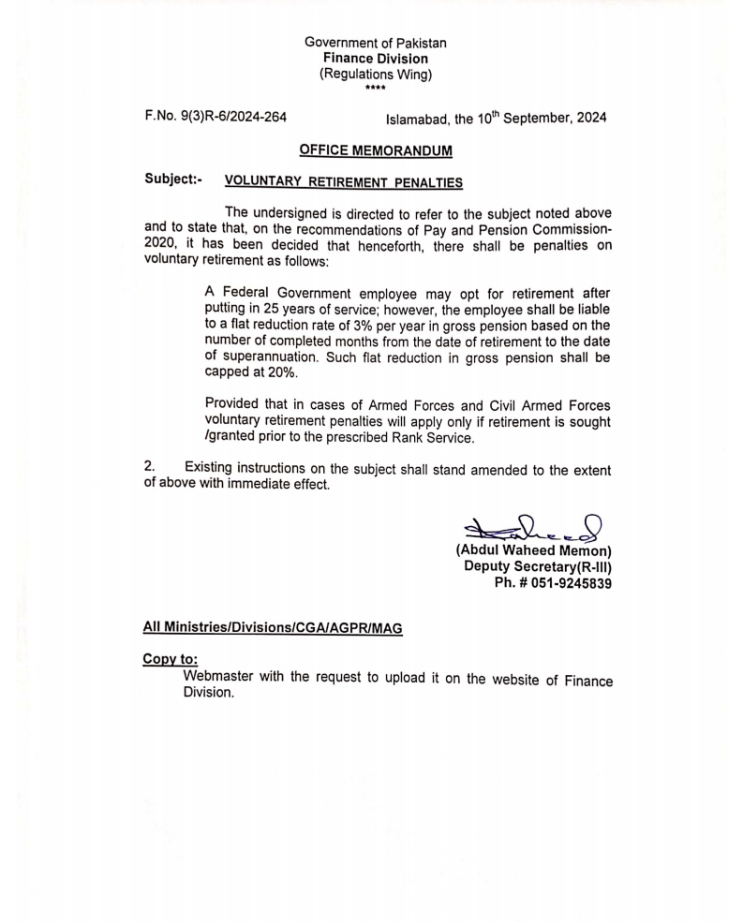

Voluntary Retirement Penalties-Federal-10.09.2024

OFFICE MEMORANDUM

Subject: Voluntary Retirement Penalties

The undersigned is directed to refer to the subject noted above and to state that, on the recommendations of Pay and Pension Commission- 2020, it has been decided that henceforth, there shall be penalties on voluntary retirement as follows:

A Federal Government employee may opt for retirement after putting in 25 years of service; however, the employee shall be liable to a flat reduction rate of 3% per year in gross pension based on the number of completed months from the date of retirement to the date of superannuation. Such flat reduction in gross pension shall be capped at 20%.

Provided that in cases of Armed Forces and Civil Armed Forces voluntary retirement penalties will apply only if retirement is sought /granted prior to the prescribed Rank Service.

Existing instructions on the subject shall stand amended to the extent of above with immediate effect.

Voluntary Retirement Penalties – Pakistan (Based on Pay and Pension Commission-2020 Recommendations)

The Pay and Pension Commission-2020 of Pakistan introduced reforms aimed at standardizing voluntary retirement penalties for federal government employees. This is in response to a growing need for reforms in the pension system to ensure its sustainability. The new regulations outline penalties for employees opting for early retirement, ensuring that while employees are given the flexibility to retire after 25 years of service, there are financial consequences to offset the burden on the pension system.

Key Provisions of the New Guidelines

The new directive allows federal government employees to voluntarily retire after completing 25 years of service. However, under these guidelines, opting for early retirement comes with penalties in the form of a reduction in gross pension. Specifically, employees will face a flat reduction of 3% in their gross pension for each year they retire before their full retirement age (superannuation).

The reduction is calculated based on the number of months between the date of early retirement and the date the employee would have reached superannuation age. This flat reduction will continue until the maximum penalty of 20% is reached. For instance, if an employee opts for voluntary retirement three years before the superannuation age, their gross pension would be reduced by 9% (3% for each year).

This penalty structure ensures that employees are discouraged from retiring too early, as the longer they serve, the smaller the penalty will be. It also provides some flexibility for those who want to retire before the standard retirement age but at a reasonable financial cost.

Special Considerations for Armed Forces and Civil Armed Forces

One important aspect of these new guidelines is the exemption applied to members of the Armed Forces and Civil Armed Forces. In their case, the voluntary retirement penalties will only apply if the retirement is sought or granted before the prescribed “Rank Service.” This means that military personnel are not subject to the 3% penalty per year as long as they retire after reaching the rank-based service requirements. This exception recognizes the unique service conditions faced by military personnel, such as the demands of early retirement due to physical fitness and operational readiness.

If members of the Armed Forces retire before completing the required Rank Service, they will be subject to the same penalties as civilian federal employees. This ensures fairness in applying pension reduction penalties, while also recognizing the distinct nature of military service.

Impact of the New Penalties

The introduction of these penalties is aimed at discouraging employees from opting for early retirement without seriously considering the financial impact. A 3% reduction per year is substantial, and when capped at 20%, the penalty can significantly affect the long-term financial well-being of a retiree. This makes it important for employees to carefully evaluate their decision to retire early, weighing the benefits of leaving service early against the potential long-term reduction in pension benefits.

For instance, an employee who retires five years before their superannuation age would face a 15% reduction in their pension. This reduction is permanent and will not be restored once they reach superannuation age. The flat-rate reduction, as opposed to a variable rate, simplifies the calculation and provides clarity to employees considering early retirement.

Conclusion

The Pay and Pension Commission-2020 recommendations have introduced a fair yet stringent penalty system for voluntary retirement in Pakistan’s federal government workforce. By allowing early retirement after 25 years of service but implementing a flat reduction of 3% per year (up to 20%), the system strikes a balance between flexibility for employees and ensuring the sustainability of the pension system. Special provisions for the Armed Forces and Civil Armed Forces highlight the unique demands of military service, providing an exception where appropriate.