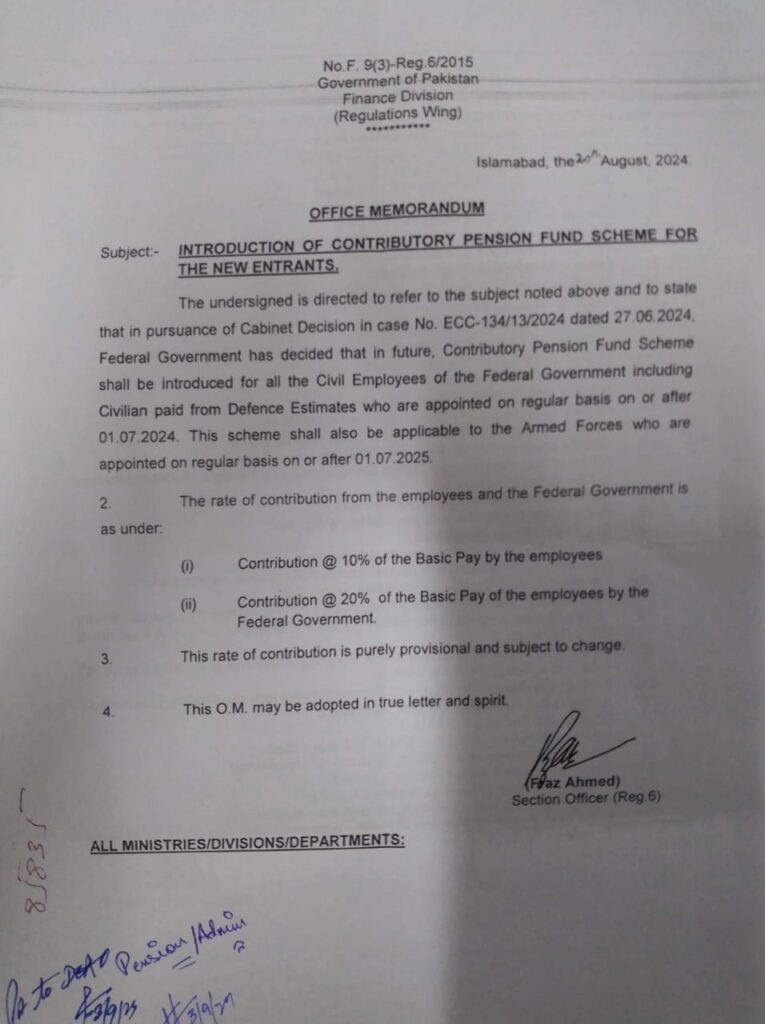

Introduction of Contributory Pension Scheme for New Entrance – Federal – 20.08.2024

OFFICE MEMORANDUM

Subject: INTRODUCTION OF CONTRIBUTORY PENSION FUND SCHEME FOR THE NEW ENTRANTS.

The undersigned is directed to refer to the subject noted above and to state that in pursuance of Cabinet Decision in case No. ECC-134/13/2024 dated 27.06.2024, Federal Government has decided that in future, Contributory Pension Fund Scheme shall be introduced for all the Civil Employees of the Federal Government including Civilian paid from Defence Estimates who are appointed on regular basis on or after 01.07.2024. This scheme shall also be applicable to the Armed Forces who are appointed on regular basis on or after 01.07.2025.

2.

The rate of contribution from the employees and the Federal Government is as under:

- Contribution @ 10% of the Basic Pay by the employees

- Contribution @ 20% of the Basic Pay of the employees by the Federal Government.

This rate of contribution is purely provisional and subject to change.

This O.M. may be adopted in true letter and spirit.

Purpose of the Scheme

The Contributory Pension Fund Scheme (CPFS) is established to ensure long-term financial security for new entrants into the workforce. The aim is to provide an organized, sustainable retirement system that balances contributions from both employees and employers, ensuring a steady income post-retirement.

Key Features of the Scheme

- Dual Contribution: Contributions are shared between employees and employers, making it a contributory plan.

- Portability: Employees can transfer their pension savings when they change jobs.

- Fund Growth: The funds are invested in regulated financial instruments, offering potential growth over time.

Eligibility Criteria

- All new entrants into the workforce as of August 20, 2024, or later.

- Participants must be above a specified age (typically 18 years or older).

Contribution Rates

- Employees: Contribute a fixed percentage of their monthly salary (e.g., 7%).

- Employers: Match or exceed employee contributions (e.g., 10%).

Benefits for New Entrants

- Security: Guaranteed pension payouts after retirement.

- Tax Reliefs: Certain contributions may qualify for tax deductions.

- Flexibility: Option to adjust contribution amounts within specified limits.

Enrollment Process

- New entrants are automatically enrolled upon employment.

- Employees will receive login details for their pension accounts, where they can monitor fund performance.

Fund Management

- Managed by government-approved pension fund administrators (PFAs).

- Funds are invested in diversified assets to minimize risk.

Regulatory Framework

- Governed by the Pension Regulatory Act, ensuring compliance with financial and ethical guidelines.

- Regular audits and reports are required to ensure transparency.

CONCLUSION

The Contributory Pension Fund Scheme for New Entrants presents a forward-looking solution aimed at ensuring the financial security of future retirees in the workforce. By sharing the responsibility between employees and employers, this scheme fosters a balanced and sustainable approach to retirement savings. It offers participants not only financial peace of mind but also flexibility and the opportunity for fund growth through diversified investments.

For new entrants, this scheme promises stability in an uncertain financial future, shielding them from the challenges of inflation and unpredictable market conditions. Its portability allows workers to carry their pensions across jobs, ensuring that no contributions are lost throughout their careers. This creates an inclusive pension structure adaptable to the modern, mobile workforce.

By introducing robust regulatory oversight, the scheme ensures transparency and trust in how funds are managed and utilized. With features such as automatic enrollment, tax reliefs, and a clear process for managing funds, the scheme is poised to become an essential part of the financial safety net for the next generation of employees.

In short, this scheme is not only a step forward in safeguarding the future of new workers but also an investment in the long-term economic health of the country.