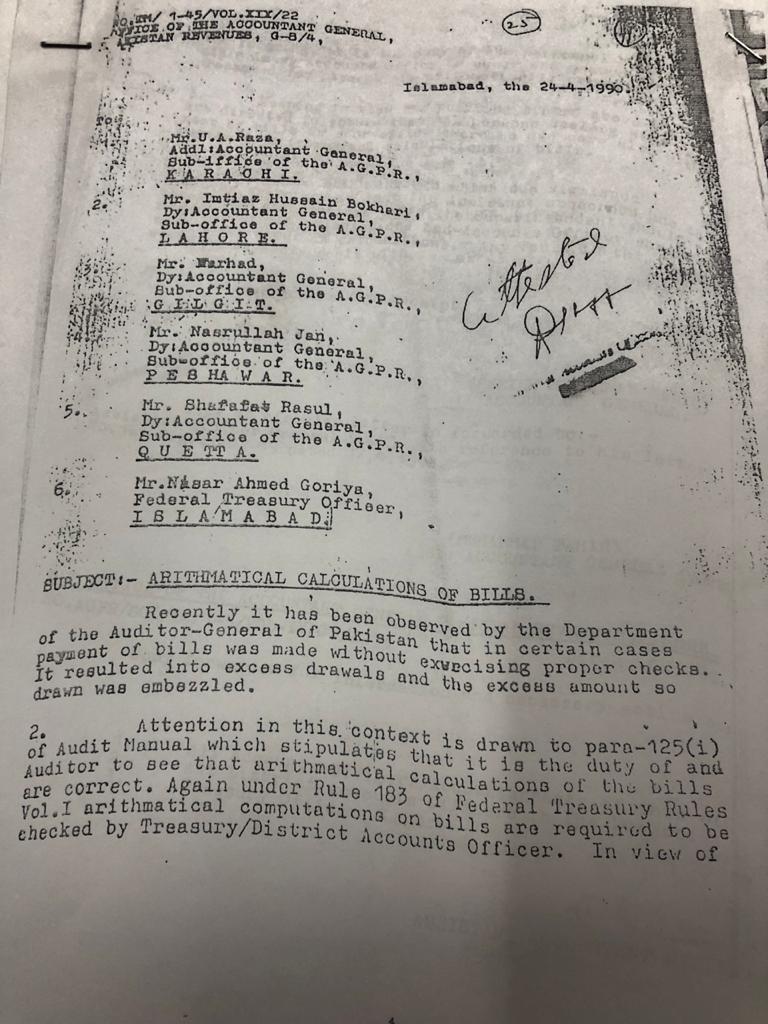

Responsibility of Arithmetical Calculations of Bills 24.04.1990

In financial management, precision and accountability are paramount. One critical aspect of maintaining financial integrity is ensuring that the arithmetical calculations on bills are accurate. The Office Order dated 24.04.1990, issued by the Accountant General’s office, underscores the importance of this responsibility. This article delves into the nuances of arithmetical calculations of bills, exploring why they are crucial, outlining the responsibilities of financial officers, and offering practical advice for maintaining accuracy in financial transactions.

Understanding the Importance of Accurate Arithmetical Calculations

Arithmetical calculations form the backbone of financial transactions in government departments and various institutions. Accurate calculations are essential to ensure that bills are processed correctly and that public funds are managed effectively. Here’s why meticulous arithmetical calculations are so important:

- Prevention of Financial Errors:Incorrect calculations can lead to significant errors, including overpayments or underpayments. Ensuring that every bill is mathematically correct helps prevent such errors, which could otherwise result in financial discrepancies and potential losses.

- Mitigation of Fraud Risks:Accurate arithmetical checks serve as a deterrent to fraudulent activities. By verifying calculations, the risk of embezzlement and financial mismanagement is minimized. This vigilance helps maintain the integrity of financial operations.

- Compliance with Legal and Regulatory Requirements:Financial transactions must comply with established rules and regulations. For instance, Rule 183 of the Federal Treasury Rules requires that all arithmetical computations on bills be checked by the Treasury or District Accounts Officer. Adhering to these regulations is essential for legal compliance.

- Maintenance of Financial Records:Precise calculations ensure that financial records are accurate and up-to-date. This accuracy is crucial for audits, financial reporting, and future reference, contributing to overall transparency.

Roles and Responsibilities in Arithmetical Calculations

Various personnel are involved in the process of ensuring accurate arithmetical calculations for bills. Understanding their specific responsibilities helps maintain the accuracy of financial transactions:

- Accounts Officers and District Accounts OfficersAccounts Officers (AOs) and District Accounts Officers (DAOs) are primarily responsible for ensuring that all arithmetical calculations on bills are correct. Their duties include:

- Verification of Calculations: AOs and DAOs must verify that all mathematical operations on bills are accurate, including addition, subtraction, multiplication, and division.

- Review of Supporting Documents: They are responsible for checking that all calculations align with the supporting documents, such as invoices, contracts, and purchase orders.

- Ensuring Rule Compliance: It is their duty to ensure that calculations and financial transactions comply with relevant rules and regulations, including Rule 183 of the Federal Treasury Rules.

- Drawing and Disbursing Officers (DDOs)DDOs play a critical role in the initial stages of the billing process. Their responsibilities include:

- Preparation of Bills: DDOs must prepare accurate bills based on the work done or services provided, ensuring that all calculations are correct before submission.

- Submission for Pre-Audit: DDOs are responsible for submitting bills to the pre-audit counter of the Accountant General or the relevant authority with proper calculations and documentation.

- AuditorsAuditors review and verify the accuracy of financial transactions, including the arithmetical calculations of bills. Their responsibilities include:

- Audit of Calculations: Auditors check the accuracy of calculations as part of their auditing duties.

- Identification of Errors: They identify discrepancies and errors in calculations and report them for correction.

Best Practices for Ensuring Accurate Arithmetical Calculations

To uphold the highest standards in financial management, it is essential to follow best practices for arithmetical calculations of bills:

- Implementing a Verification ChecklistA detailed checklist can guide the verification process for arithmetical calculations. The checklist should include:

- Verification of all mathematical operations.

- Cross-checking calculations against original documents.

- Reviewing calculations for accuracy and completeness.

- Utilizing Automated ToolsAutomated tools and financial software can reduce human error in arithmetical calculations. These tools often include built-in functions for complex calculations and error-checking features.

- Training and DevelopmentRegular training sessions for financial staff on the importance of accurate calculations and the latest tools and techniques can enhance their skills and knowledge.

- Establishing a Review ProcessA structured review process involving multiple checks and balances can ensure that calculations are correct. This process might include peer reviews or supervisory checks.

- Maintaining Proper DocumentationKeeping thorough records of all calculations and supporting documents is crucial for transparency and future reference. Well-maintained records facilitate audits and reviews.

Challenges in Ensuring Accurate Arithmetical Calculations

Despite best efforts, several challenges can arise in the process of ensuring accurate arithmetical calculations:

- Complex CalculationsComplex calculations involving multiple steps or variables can lead to errors. Providing additional support or using advanced software can help manage complexity.

- High Volume of TransactionsHandling a large number of transactions can lead to oversight. Implementing efficient processes and tools can help manage high volumes effectively.

- Staff TurnoverFrequent changes in staff can lead to inconsistent practices. Developing comprehensive training programs and documentation can help mitigate this challenge.

Conclusion

The responsibility of arithmetical calculations of bills is a fundamental aspect of financial management in government offices. Ensuring that these calculations are accurate is essential for maintaining financial integrity, preventing fraud, and complying with legal regulations. By understanding the roles and responsibilities of various personnel and implementing best practices, organizations can uphold the highest standards of financial management.

Adhering to Rule 183 of the Federal Treasury Rules and the guidelines issued in the Office Order dated 24.04.1990 is crucial for effective financial oversight. Through rigorous verification, effective training, and the use of automated tools, financial officers can ensure that all arithmetical calculations are accurate and that public funds are managed responsibly.