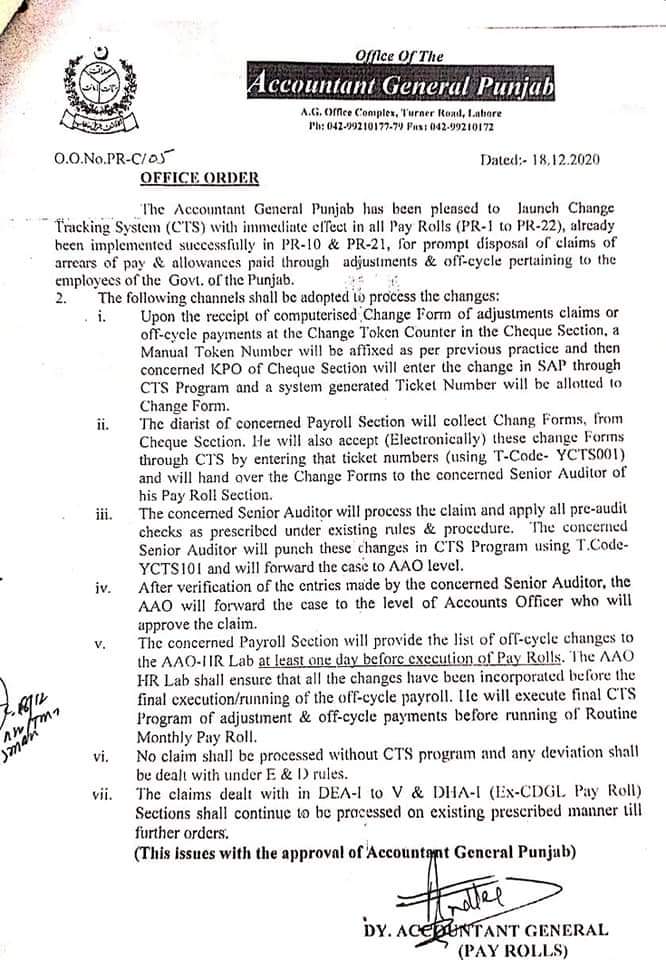

Processing of Claims through Change Tracking System CTS – AG 18.12.2020

In a bid to streamline and enhance the efficiency of financial operations, the Accountant General Punjab has introduced the Change Tracking System (CTS) as outlined in Office Order No. PR-C/o dated 18.12.2020. This system, already successfully implemented in PR-10 and PR-21, is now extended to all Pay Rolls (PR-I to PR-22). The primary goal of CTS is to ensure the prompt and accurate processing of claims related to arrears of pay, allowances, and off-cycle adjustments for government employees in Punjab. This article will explore the key aspects of the CTS, the steps involved in processing claims, and the implications for effective financial management.

What is the Change Tracking System (CTS)?

The Change Tracking System (CTS) is a comprehensive digital tool designed to track and manage changes in pay and allowances for government employees. CTS facilitates the management of adjustment claims, off-cycle payments, and ensures that all changes are documented and processed in an orderly and efficient manner. By integrating advanced tracking mechanisms with SAP systems, CTS aims to minimize errors, enhance transparency, and expedite the processing of claims.

Why Implement the CTS?

The implementation of CTS addresses several critical issues in the traditional claims processing system:

- Error Reduction: CTS helps reduce errors by providing a systematic approach for tracking changes, thus minimizing manual errors.

- Enhanced Transparency: With CTS, every change is logged, tracked, and reviewed, ensuring transparency in how claims are managed and processed.

- Efficient Processing: The system streamlines the process for handling adjustment claims and off-cycle payments, speeding up the overall workflow.

- Accountability: By creating a clear audit trail, CTS enhances accountability among those involved in the claims processing.

Step-by-Step Process for Claim Processing through CTS

Here’s a detailed look at how claims are processed through the Change Tracking System:

1. Receipt and Initial Processing of Change Forms

Upon receiving the computerized Change Form for adjustment claims or off-cycle payments at the Change Tracking Counter in the Cheque Section, the following steps are taken:

- Token Number Assignment: A Manual Token Number is assigned to each Change Form.

- Data Entry: The KPO (Key Punch Operator) of the Cheque Section enters the change details into the SAP system through the CIO Program, generating a system-generated Ticket Number for the Change Form.

Keywords: Change Form, Token Number, CIO Program, SAP System, Ticket Number

2. Collection and Entry of Change Forms

The Diarist of the concerned Payroll Section collects the Change Form from the Cheque Section. The Diarist also accepts these forms electronically through CTS by entering the Ticket Numbers using T-Code YCTSOOI and hands over the forms to the concerned Senior Auditor.

Keywords: Diarist, Payroll Section, T-Code YCTSOOI, Senior Auditor, Change Forms

3. Claim Processing and Pre-Audit Checks

The Senior Auditor processes the claims by applying all pre-audit checks as per existing codes and procedures. This includes verifying the accuracy of the data and ensuring compliance with the prescribed guidelines.

- Data Entry: The Senior Auditor punches the changes into the CTS Program using T-Code YCTS101 and forwards the case to the AAO (Assistant Accounts Officer) for further review.

Keywords: Senior Auditor, Pre-Audit Checks, T-Code YCTS101, CTS Program, Assistant Accounts Officer

4. Verification and Approval

The AAO verifies the entries made by the Senior Auditor. After successful verification, the AAO forwards the case to the Accounts Officer for approval.

- Approval Process: The Accounts Officer reviews the claim and approves it for further processing.

Keywords: AAO, Verification, Accounts Officer, Claim Approval, Financial Management

5. Final Execution of Claims

Before executing the off-cycle payroll, the AAO HR Lab must ensure that all changes have been incorporated. The AAO HR Lab will execute the final CFS (Central Financial System) Program for adjustment and off-cycle payments, ensuring that all changes are correctly reflected before running the routine monthly payroll.

Keywords: AAO HR Lab, CFS Program, Off-Cycle Payroll, Adjustment Payments

6. Compliance and Deviation Management

It is mandatory that no claim is processed without using the CTS program. Any deviations from this process will be addressed under the relevant rules.

Keywords: Compliance, CTS Program, Deviation Management, Financial Rules

7. Exceptions and Existing Procedures

Claims managed in DEA-1 to V & DI 1A-1 (IN-C1)(il. Pay Roll) Sections will continue to follow existing procedures until further notice.

Keywords: DEA-1, V & DI 1A-1, Existing Procedures, Claims Management

Implications of the Change Tracking System

The introduction of CTS has significant implications for the financial management of government employees’ pay and allowances:

- Improved Accuracy: CTS ensures that all calculations and adjustments are accurate, reducing the risk of financial discrepancies.

- Enhanced Efficiency: By automating the process and providing a structured approach for claims processing, CTS increases overall efficiency.

- Strengthened Internal Controls: CTS supports stronger internal controls through transparent tracking and systematic processing of claims.

Conclusion

The launch of the Change Tracking System (CTS) by the Accountant General Punjab marks a significant step towards modernizing and optimizing the claims processing procedures for government employees. By adopting a structured, transparent, and efficient approach to managing adjustment claims and off-cycle payments, CTS aims to improve financial accuracy and accountability.

All Accounts Officers, Pay Roll Sections, and District Accounts Offices in Punjab are required to adhere strictly to the procedures outlined in the Office Order dated 18.12.2020. This adherence will not only ensure compliance with financial rules but also contribute to a more transparent and efficient financial management system.