Processing of bills by the Authorized Auditor -AG 22.03.2021

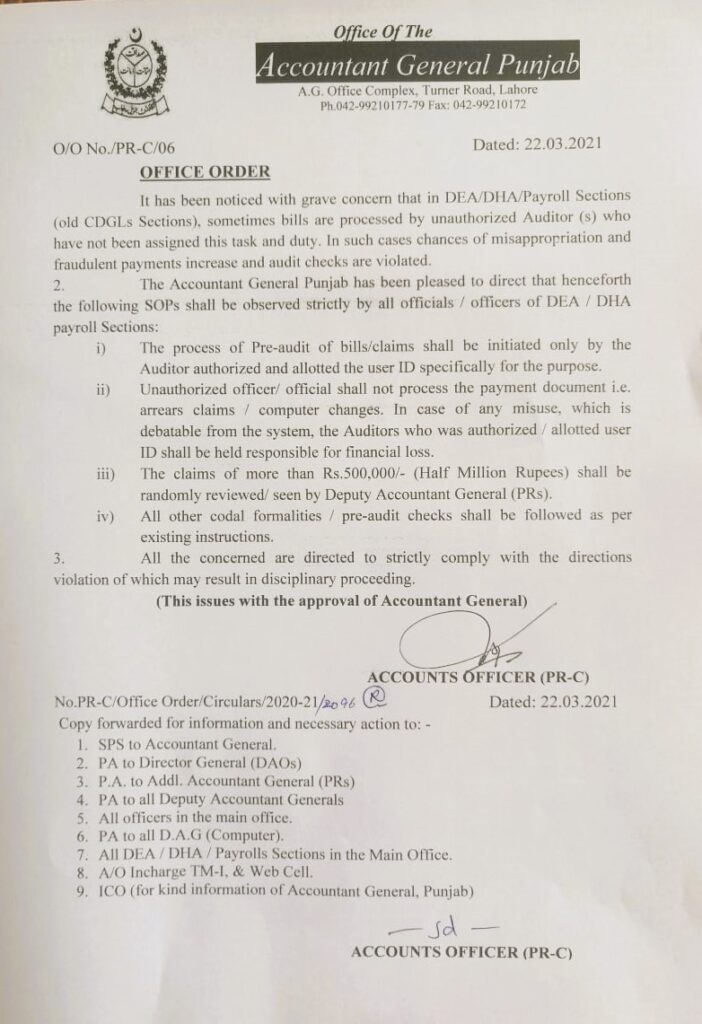

On March 22, 2021, the Accountant General Punjab issued an important Office Order aimed at strengthening the internal controls within the DEA/DI IA/Payroll Sections. This directive addresses critical issues related to the processing of bills and claims, emphasizing the need for stringent adherence to established procedures. The order outlines new Standard Operating Procedures (SOPs) to mitigate risks associated with unauthorized bill processing and to enhance the integrity of the financial management system. This article explores the significance of these guidelines, the procedures they enforce, and their impact on maintaining transparency and accountability in financial operations.

The Importance of Authorized Auditors in Bill Processing

In financial management, authorized auditors play a crucial role in ensuring the accuracy and legitimacy of bills and claims. Their responsibilities include verifying the correctness of financial documents, ensuring compliance with legal standards, and preventing fraud. The recent Office Order underscores the necessity of having only qualified and designated personnel handle bill processing tasks. By reinforcing these guidelines, the Accountant General Punjab aims to safeguard against misappropriation and ensure that all financial transactions are conducted with the highest level of integrity.

Key Procedures Established by the Office Order

1. Initiation of Pre-Audit Processes by Authorized Personnel

One of the central directives of the new SOPs is that only auditors who have been officially authorized and assigned a specific user ID can initiate the pre-audit process for bills and claims. This measure ensures that only trained professionals with the necessary credentials are involved in the financial review and approval processes. By centralizing this responsibility, the order aims to reduce the risk of errors and fraudulent activities that could arise from having unauthorized individuals handle sensitive financial tasks.

2. Prohibition of Unauthorized Bill Processing

The Office Order mandates that no unauthorized officer or official should process payment documents such as arrears claims and computer changes. This prohibition is designed to prevent the misuse of authority and ensure that all financial documents are handled by individuals with the appropriate level of responsibility and expertise. If unauthorized processing occurs, the authorized auditor whose user ID was misused will be held accountable for any resulting financial discrepancies or losses.

3. Random Review of High-Value Claims

To further enhance oversight, the new SOPs require that any claims exceeding Rs. 500,000 be subject to a random review by the Deputy Accountant General (Pits). This additional layer of scrutiny is intended to provide a check on large transactions and ensure that high-value claims are thoroughly reviewed. This step is crucial for maintaining the accuracy and validity of significant financial transactions and helps to prevent potential misuse of funds.

4. Adherence to Codal Formalities and Pre-Audit Checks

The guidelines also emphasize the importance of following existing codal formalities and pre-audit checks as per established instructions. These procedures include verifying the accuracy of bills, ensuring compliance with legal requirements, and performing routine checks to confirm that all transactions are valid. By adhering to these formalities, the SOPs aim to uphold the integrity of the bill processing and payment procedures.

How These Procedures Strengthen Financial Management

The new SOPs outlined in the Office Order are designed to reinforce the financial management system by addressing key areas of concern and implementing robust procedures for bill processing.

1. Minimizing Opportunities for Fraud

By restricting bill processing to authorized auditors and setting up a system of checks and balances, the new procedures aim to minimize opportunities for fraudulent activities. Ensuring that only qualified personnel handle bill processing tasks helps to prevent unauthorized access and potential misuse of financial resources.

2. Ensuring Accountability and Responsibility

The Office Order establishes clear lines of accountability for financial transactions. Unauthorized processing of bills will result in disciplinary action for the responsible auditor, thereby creating a strong incentive for auditors to adhere to their duties and report any irregularities. This approach reinforces the importance of personal responsibility in maintaining financial integrity.

3. Enhancing Transparency in Financial Transactions

The introduction of random reviews for high-value claims and the strict enforcement of pre-audit checks are measures designed to enhance transparency in financial transactions. By increasing oversight and scrutiny, these procedures ensure that all financial activities are conducted openly and in accordance with legal and procedural standards.

Implementing and Adhering to the New SOPs

The successful implementation of these SOPs requires a commitment from all officials and officers within the DEA/DI IA/Payroll Sections to adhere to the new guidelines. Training sessions and awareness programs will be essential for ensuring that all staff members understand the specifics of the new procedures and the importance of compliance.

Training and Awareness Initiatives

To support the implementation of these SOPs, comprehensive training and awareness initiatives should be organized for all relevant staff members. These programs should cover the details of the new procedures, explain the reasons behind the changes, and outline the consequences of non-compliance. Effective training will help ensure that all personnel are well-informed and prepared to follow the new guidelines.

Conclusion

The Office Order issued by the Accountant General Punjab on March 22, 2021, represents a significant advancement in the efforts to maintain financial discipline and transparency within the Accountant General’s office. By establishing clear guidelines for who can process bills, implementing a system of checks for high-value claims, and emphasizing adherence to codal formalities, these SOPs are designed to strengthen the financial management framework and prevent fraud.

Through these measures, the Accountant General Punjab aims to uphold the principles of accountability, transparency, and integrity in all financial transactions. As these new procedures take effect, it is essential for all staff members to understand and embrace the changes to ensure that the objectives of the Office Order are met.

By fostering a culture of responsibility and diligence, these guidelines seek to protect public funds and ensure that the financial operations of the Accountant General Punjab’s office are conducted with the utmost professionalism and care.